Blog

Recent Posts

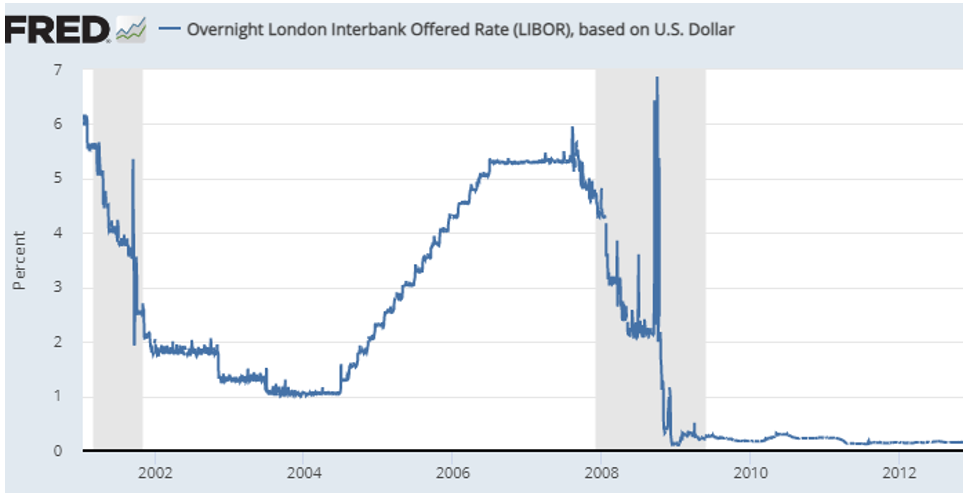

The LIBOR Transition, Part 3: No SOFR for FHA

February 19, 2021 •Mark Hutson

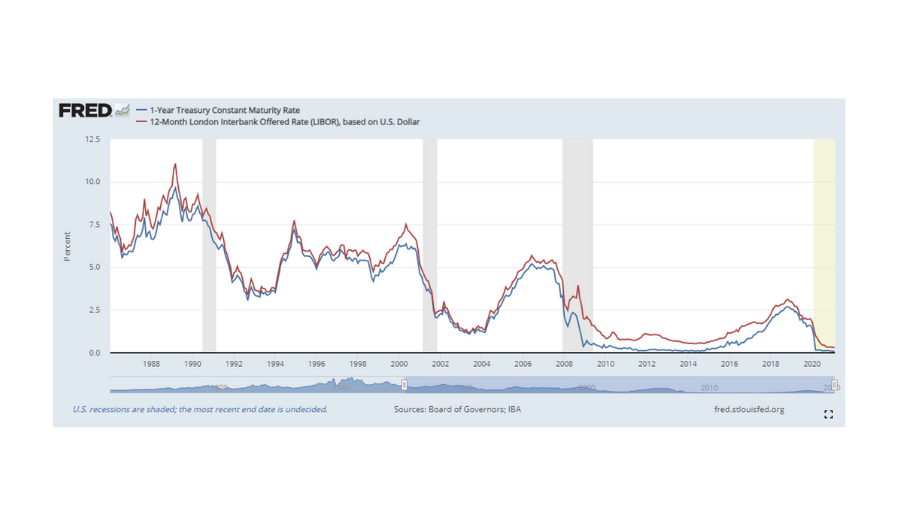

The LIBOR Transition, Part 1: SOFR, So Good

January 29, 2021 •Mark Hutson

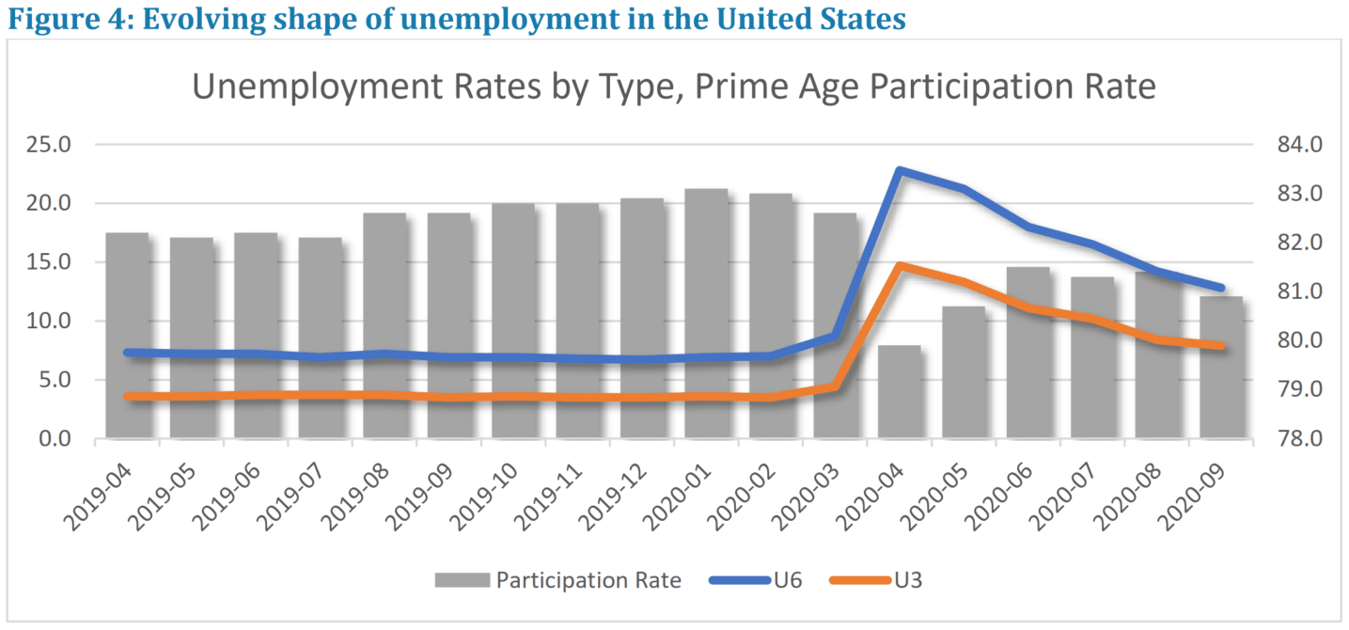

Economist’s Corner: Indicators to watch this fall

October 23, 2020 •Mark Hutson

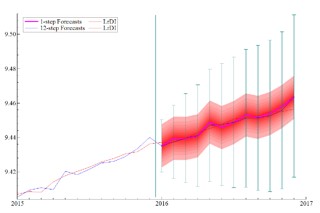

Modeling COVID-19's Impact

March 25, 2020 •Mark Hutson

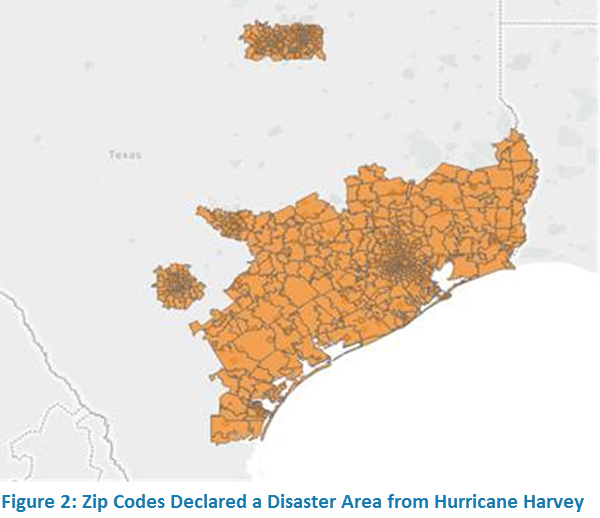

Summit Uses Analytics to Estimate Hurricane Impacts on Operations

September 13, 2018 •Mark Hutson

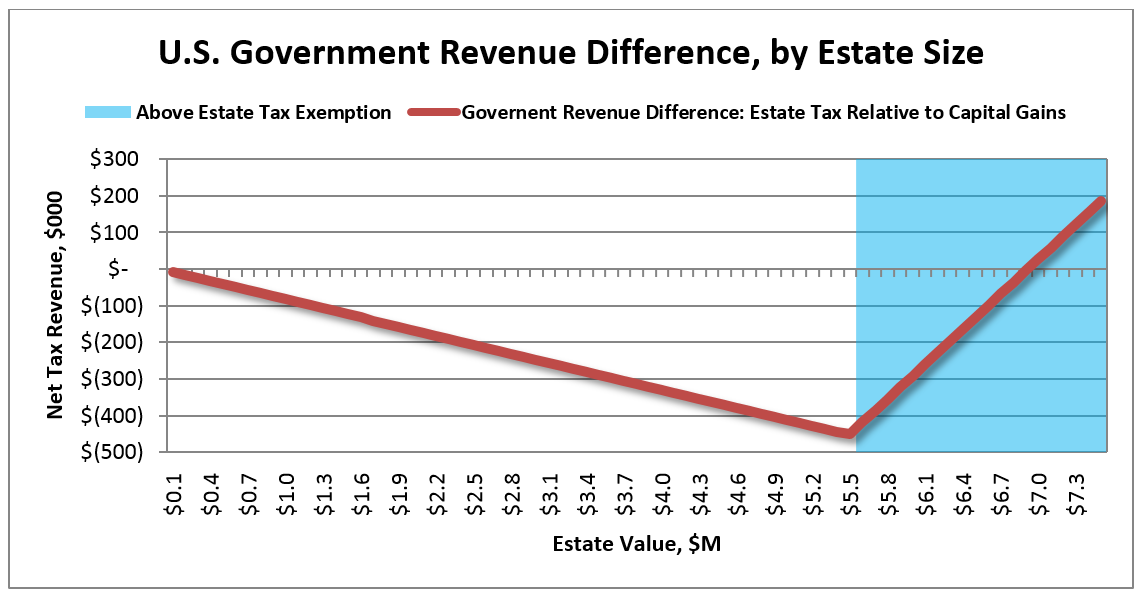

IN THE NEWS: The Estate Tax, Part 2 – Reducing Complexity for Heirs

December 15, 2017 •Mark Hutson

.png?height=630&name=Untitled%20design%20(21).png)