The LIBOR Transition, Part 3: No SOFR for FHA

February 19, 2021 •Mark Hutson

With contributions by Josh Goldberg

This is the third in a series on the end of the London Inter-Bank Offered Rate (LIBOR), a widely used financial metric that is integral to global finance. In this post, we discuss the implications for the reverse mortgage market not adopting SOFR (yet). In the past two posts, we covered why LIBOR is being discontinued and what is going to be the primary replacement. As the publishing deadline for LIBOR approaches, and as we see more headlines like this one that quantify the expected costs of discontinuing LIBOR, we are pivoting the focus of the series to discuss the implications for some of our clients here at Summit.

Why Federal Mortgage Support Is Eschewing SOFR

This past fall, as preparation ramped up for the end of LIBOR, a curious thing happened in the reverse mortgage market: The Federal Housing Administration (FHA) announced that starting on January 29, 2021, they would only insure Home Equity Conversion Mortgages, or HECMs, that were tied to the Constant Maturity Treasury index (CMT). This makes the HECM market one of the few floating-rate instruments that is not going to be tied to SOFR.

|

What’s a HECM? A Home Equity Conversion Mortgage is a loan against the equity a borrower has in their primary residence. Borrowers need not pay back any of the loan until they sell the property or the borrower dies, at which point the HECM is repaid. HECMs can provide a key source of income for seniors whose only major asset is their primary residence. |

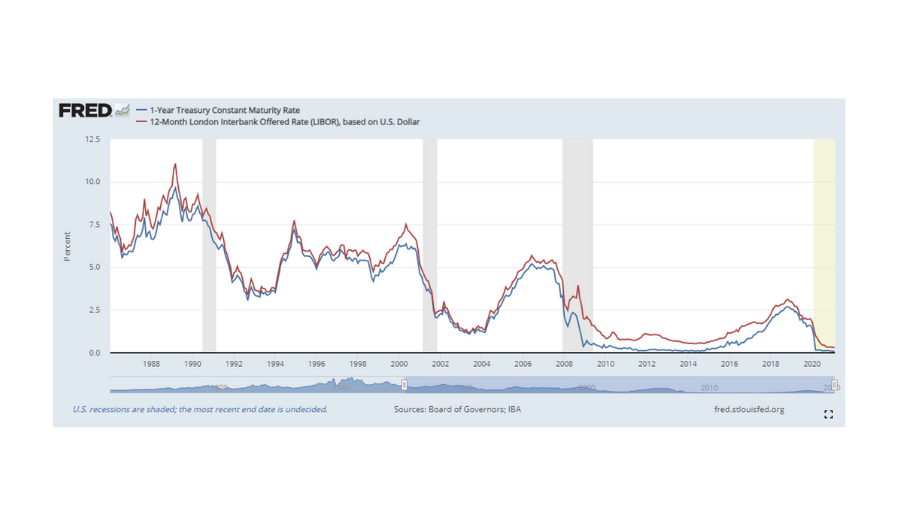

HECMs already hold a unique place in the housing market. Traditional “forward” mortgages, and securitized bonds from pooled groups of mortgages, tend to be impacted by swings in both the economy and the housing market; forward mortgages tend to have fixed interest rates and repay or refinance when interest rates drop. HECMs, in contrast, are less sensitive to economic activity (such as unemployment and gross domestic product), and these also tend to have adjustable rates (see Figure 1 below). As a result, HECMs serve as a more defined bet on the housing market, as the risks of default and refinance or prepayment are much less correlated with performance. Because of this, HECMs have always had a much different place in the financial world relative to other mortgage-based products. By not adopting SOFR, the FHA is further distancing the adjustable-rate HECM market from other mortgage products.

Figure 1: Fixed vs. floating-rate HECMs over time

|

HECMs vs. Reverses HECMs are a large subset of reverse mortgages. Specifically, HECMs are reverse mortgages insured by the Federal Housing Administration. |

The question then is this: Why is FHA adopting a different interest rate? In some ways, the choice makes sense. Rather than transferring over to SOFR, FHA is instead reverting to interest rates that they were using prior to phasing in LIBOR in 2007 or 2008 (depending on the instrument). The more curious question is why they implemented this change a year earlier than expected. This faster (re-)adoption of CMT forced many market participants to scramble to adjust their lending to CMT much more quickly than anticipated, especially in the secondary securitization markets.

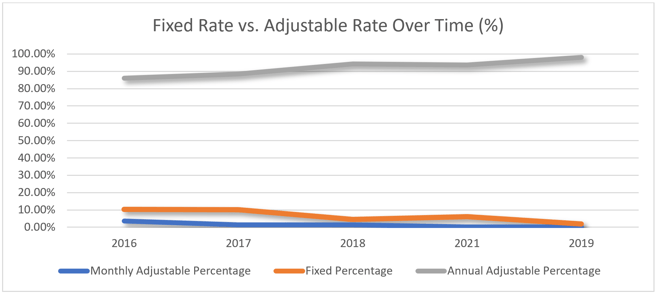

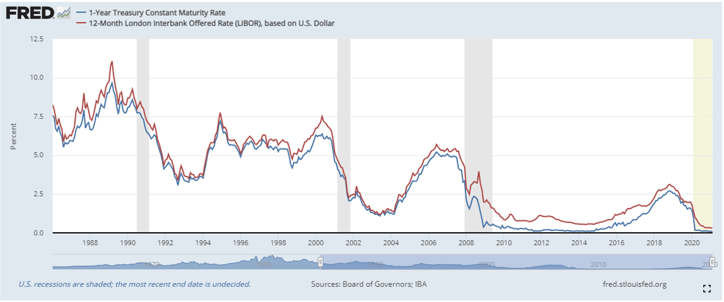

What impact does this shift back to CMT have on FHA and its operation? Because HECMs are an adjustable-rate instrument, the underlying indexed interest rate directly determines the profitability for the lender and the costs over time for the borrower. Shifting away from LIBOR-based estimates to solely CMT means that FHA effectively is only endorsing loans based on a rate consistently lower than traditional LIBOR (see Figure 2 below). While this is likely to be reflected in the interest-rate structure for future resets, the relative swiftness of the transition meant that many originators had to move quickly to convert newer issuances to CMT if they wanted to be able to securitize these loans.

Figure 2: CMT vs. LIBOR: CMT historically is lower than LIBOR

Overall, though, the impact of the change is expected to be minimal. Since HECMs, and securitized bonds based on pools of HECMs, already play a unique role in the market, this transition merely cements the product’s place as an alternative investment to traditional forward mortgages. For FHA, this also ties their profitability more closely to their true funding costs. Although FHA is funded entirely by mortgage premiums, as a government agency they are backstopped by the Treasury. Thus, their risk profile and implicit funding costs are more closely reflected in the government’s funding costs rather than those of large banks (which is what SOFR measures). Using CMT eliminates the implicit default risk buried in SOFR transactions, better reflecting FHA’s funding profile. If there is a market impact, it will most likely just be that the pricing wedge between FHA-endorsed HECMs and other reverse mortgage products is likely to widen, with FHA scooping up an even larger portion of the market than they already do as their funding cost is likely to be persistently below the 1-year compounded SOFR.

Regardless, January saw a tremendous amount of issuance in the HECM and HMBS market. Thus, there are a lot of new HECMs out there and a healthy appetite for securitizing those pools. The year 2021 looks to be an interesting one for HECMs, regardless of whether FHA stays with CMT or eventually switches to SOFR.

This is the third post in a series on the LIBOR transition. Topics include:

- Part 1: The LIBOR transition—SOFR, so good

- Part 2: Challenges associated with SOFR

- Part 4: The cost of LIBOR—mortgages, damages, and consumer protection

- Part 5: LIBOR and USDA—how removing the LIBOR cap will impact the Farm Service Agency

- Part 6: SOFR at the U.S. Treasury

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)