Blog

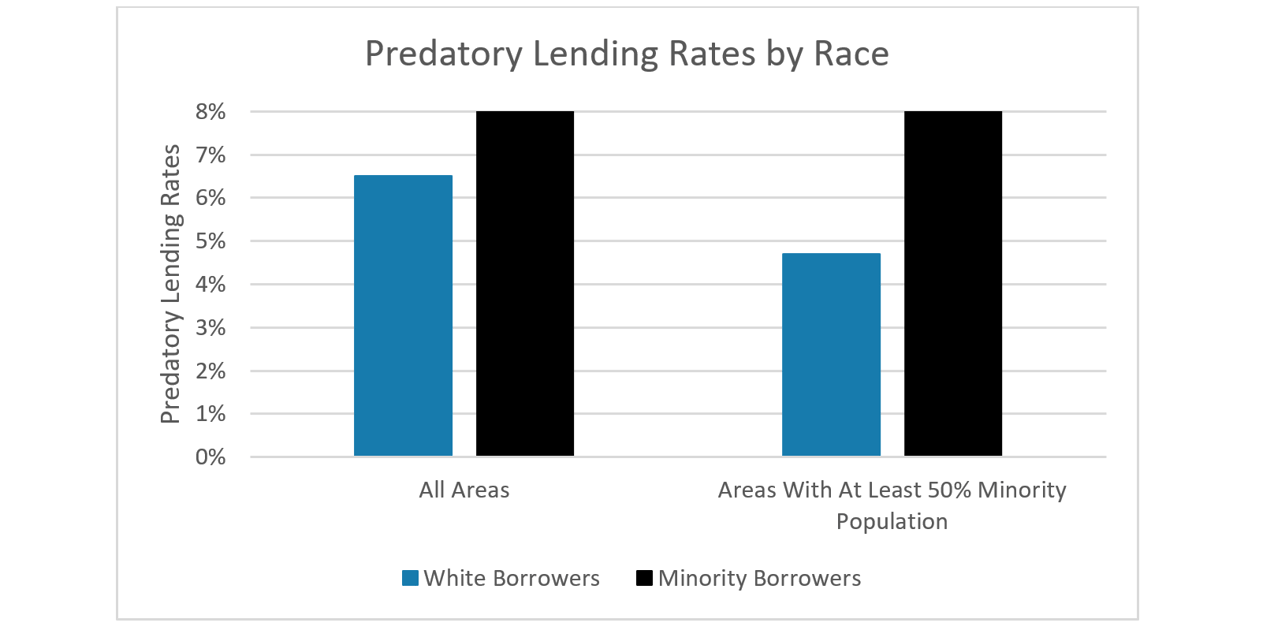

Fair Lending: Predatory Lending and Origination Discrimination

January 21, 2021 •Kami Ehrich

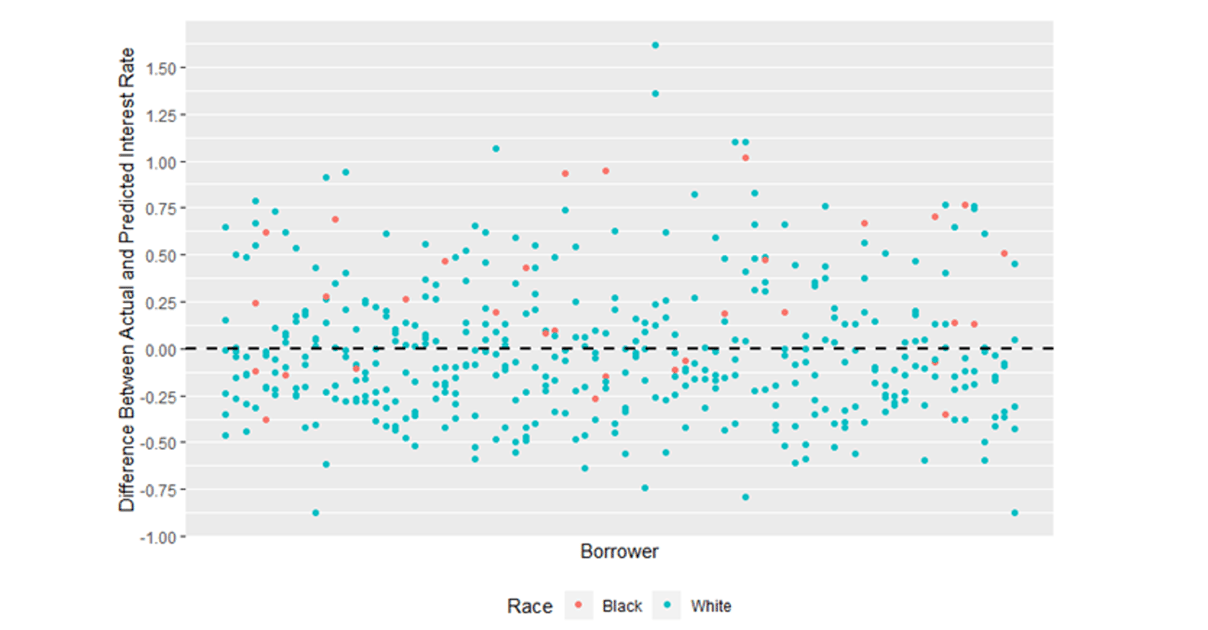

Fair Lending: How to Detect Loan Pricing Discrimination

January 14, 2021 •Michael Easterly

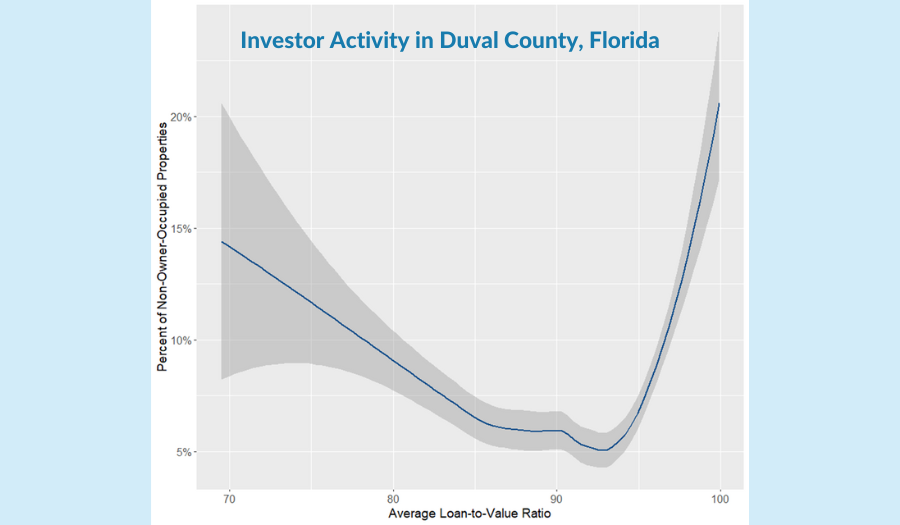

Summit Releases New Fair Lending White Paper

August 23, 2017 •Eva Palmer

New HMDA Rule Could Save Home Buyers Time and Money

November 18, 2015 •Kevin Danielson

What Is Redlining and How Does It Relate to HMDA?

November 4, 2015 •Oge Ezeokoli

.png?height=630&name=Fair%20Housing%20Registration%20Collateral%20(final).png)