The LIBOR Transition, Part 1: SOFR, So Good

January 29, 2021 •Mark Hutson

This is the first in a series on the end of the London Inter-Bank Offered Rate (LIBOR), a widely used financial metric that is integral to global finance. In this post, we cover why LIBOR is being discontinued, why that is important, and what is replacing it.

In December 2021, one of the most important interest rates in the world will cease to exist. This is a change that has been in the works for nearly a decade, and it will have (and already is having) far-reaching implications for individuals, banks, markets, and governments throughout the world. But before we get into why eliminating LIBOR will have such an impact, we will first discuss why it is being eliminated.

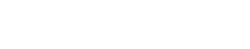

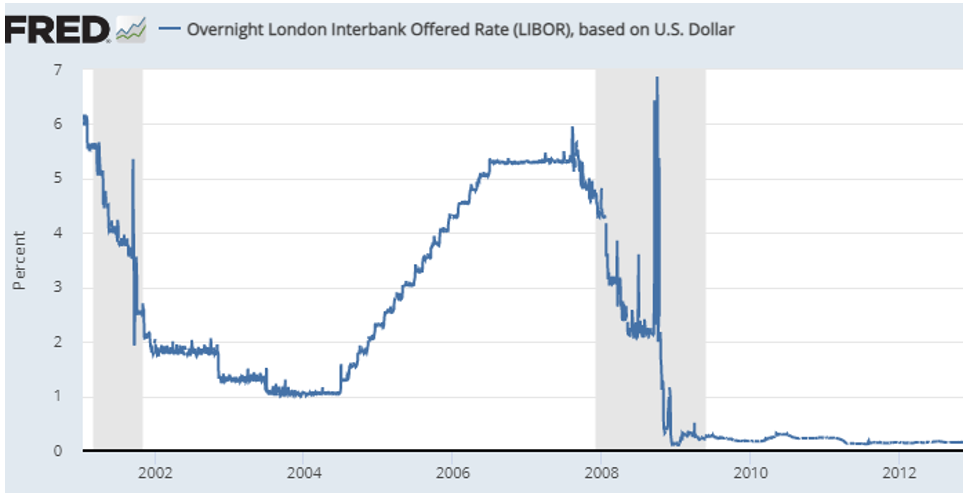

Figure 1: Historical LIBOR rate

How Can You Eliminate an Interest Rate?

An interest rate, inherently, is the amount of money it costs to borrow money. So if we are eliminating LIBOR, the question becomes: What types of loans are being eliminated along with LIBOR? The short, slightly quizzical answer is none. This gets at the crux of the fundamental problem with LIBOR, which is that nobody actually borrows money at the LIBOR rate.

| Technically, LIBOR is calculated as the 22% trimmed mean of a panel of 18 banks’ self-reported cost of funding at seven different maturities in up to 16 different currencies. But who’s counting? |

LIBOR, rather, represents the average interest rate that banks report they could borrow from other banks. (See the box at right for the in-depth explanation.) With a slight simplification, LIBOR is the average interest that banks self-report what they perceive a loan would cost if they went to the interbank market. Those three terms underpin why regulators are eliminating it, so let’s look at each (in reverse order):

- Would: The banks’ interest rate estimates are meant to be forward-looking for the next business day, rather than what their rate currently is. Thus, the reported rates in LIBOR are banks’ forecast rather than their actual costs.

- Perceive: The bank is not forecasting the actual rate they expect, but rather what they expect it will cost if they borrow. While most banks are deeply involved in the markets most days, this allows them to calculate their own credit-risk premium (that is, they can assess how other market participants assess their risk of default) rather than use the actual market price of their risk.

- Self-Report: Banks only have to report their own estimated interest rate, which may or may not reflect their true internal perception of what such loans would cost. They also do not need to justify how they calculated this number. That is, they can lie, and, in fact, they have—which is why the rate is getting scrapped.

So LIBOR is being eliminated because it is squishy to calculate, is not verified, and has been manipulated by bad actors at banks. The latter led to a scandal in 2012, which is why regulators decided to cancel the rate by the end of 2021.

If Nobody Borrows at LIBOR, Why Is It a Big Deal to Get Rid of It?

Even though LIBOR is not the specific rate on a transaction type, it is used as an index rate for all kinds of loans across the world. In fact, more loans have probably been based on LIBOR than all other metrics in human history (in nominal terms, at least). Because LIBOR is meant to be the true cost of funding for banks, it is the reference point to price loans as follows:

Interest Rate = LIBOR + Premium

That is, the interest rate is equal to LIBOR plus some premium that includes borrower- or loan-specific consideration (default risk, collateral quality, etc.). This formula is most frequently used in the context of floating-rate products like credit cards, but it can also be used in fixed-rate products based on LIBOR from the date of origination. As such, this rate impacts credit cards, mortgages, business loans, and a whole host of other loan types, with varying estimates of up to $350 trillion in outstanding debt connected to the LIBOR rate at its height.

This means that just about every variable-rate loan anybody made in the financial system was in some way impacted by LIBOR prior to the LIBOR scandal. In practical terms, LIBOR’s importance means that a shift of even 1 basis point (or 0.01%) could swing billions of dollars of interest costs between borrowers and lenders. So yeah, getting rid of LIBOR is a big deal.

OK, LIBOR Needs to Go. Now What?

LIBOR existed to fill a market need, namely that lenders and regulators alike know how much it costs to fund lending. Having a well-respected market interest rate facilitates transactions, reducing friction from rate negotiations by providing an agreed-upon launching point. Thus, LIBOR can’t just disappear one day without leaving chaos in its wake. Instead, the financial system has embarked on a lengthy process to replace it:

- Decide on a new reference rate. Different countries are doing a number of things, but most entities in the U.S. plan to use the Secured Overnight Financing Rate (SOFR). To radically oversimplify what SOFR is, it is the rate that banks have actually lent to each other over the past day. SOFR is what LIBOR was meant to be, albeit backward-looking for a day rather than a projection for the next morning.

- Give time to let old contracts expire. Unfortunately, swapping interest rates isn’t as simple as changing from one rate to another. Many of the legally-binding contracts did not have provisions for swapping out LIBOR, so LIBOR needed to persist in some form for many of the contracts that existed prior to the LIBOR scandal.

- Institute requirements to use something else. Regulators across the world started instituting requirements that all new contracts have provisions for adopting a replacement interest rate, and most older contracts without that language will have expired by the end of 2021. For continuity, however, LIBOR will still be calculated until June 2023 (though not published).

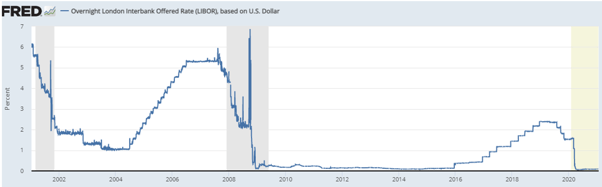

- Allow market participants to prepare for disruption. Of course, because SOFR is based on actual lending rather than private self-reported forecasts, the reality of switching to it is proving much more complicated and thorny than simply changing a number, as shown in Figure 2.

Figure 2: LIBOR is much less volatile than SOFR

In next week’s post, we will cover some of the issues caused by switching from LIBOR to SOFR.

This is the first post in a series on the LIBOR transition. Upcoming topics include:

- Part 2: Challenges associated with SOFR

- Part 3: Why FHA is not using SOFR

- Part 4: The cost of LIBOR—mortgages, damages, and consumer protection

- Part 5: LIBOR and USDA—how removing the LIBOR cap will impact the Farm Service Agency

- Part 6: SOFR at the U.S. Treasury

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)