Blog

White Paper: Fair Value Accounting in Federal Credit

March 12, 2025 •Anthony Curcio

Transitions: Managing Change While Maintaining Stability

February 7, 2025 •Sarah Cunningham

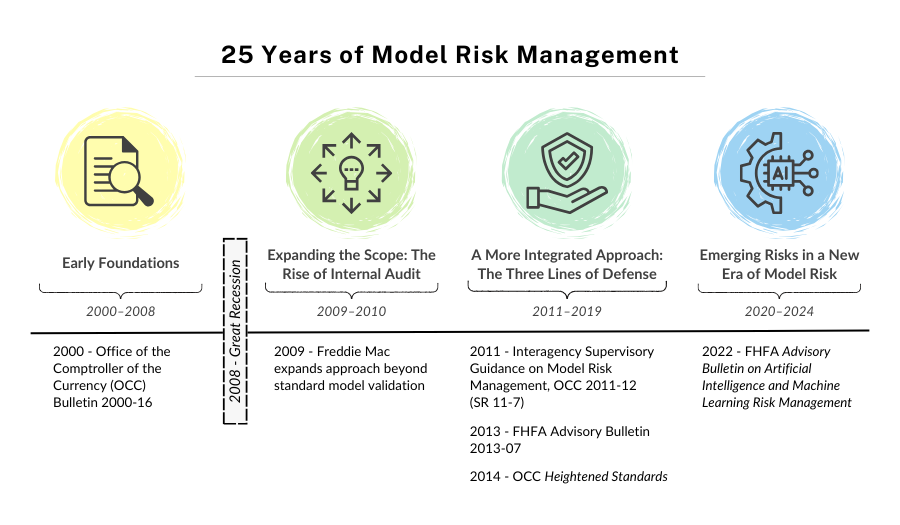

The Evolution of Model Risk Management: From Regulation to Practice

November 21, 2024 •Josh Goldberg

Wrap-Up: American Evaluation Association 2024 Conference

November 8, 2024 •Hayley Carter

Using Evidence in the Fight Against Fraud

November 1, 2024 •Teresa Kline

Capital Ideas: How Does FHA Loan Pricing Work?

October 23, 2024 •Josh Goldberg