Blog

The Biden Plan: What Is the New First-Time Home Buyer Tax Credit?

January 25, 2021 •Jacob Trout

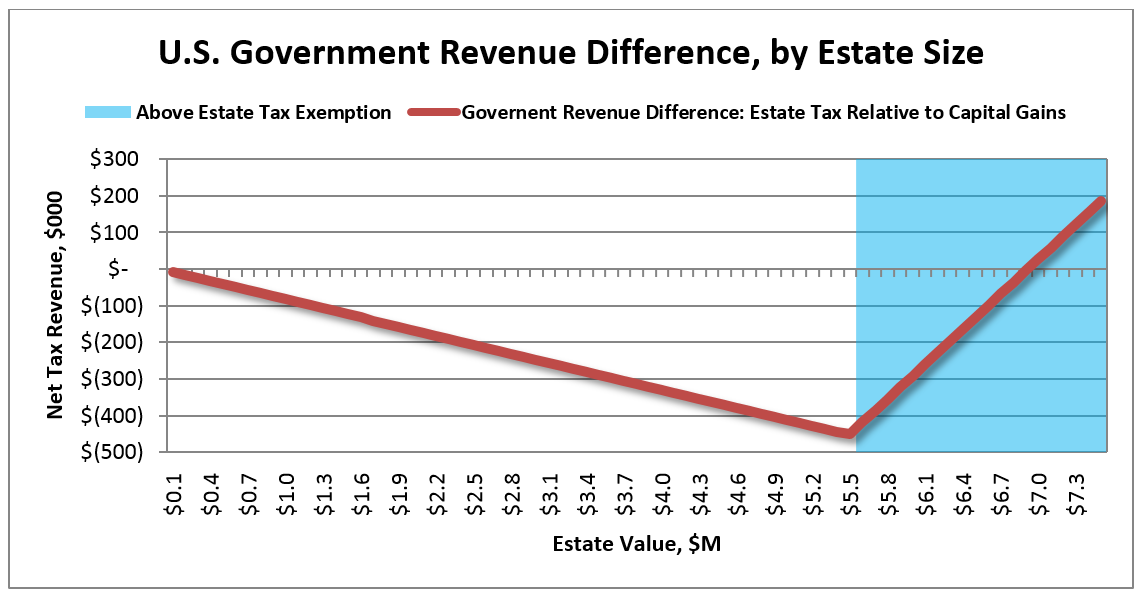

IN THE NEWS: The Estate Tax, Part 2 – Reducing Complexity for Heirs

December 15, 2017 •Mark Hutson

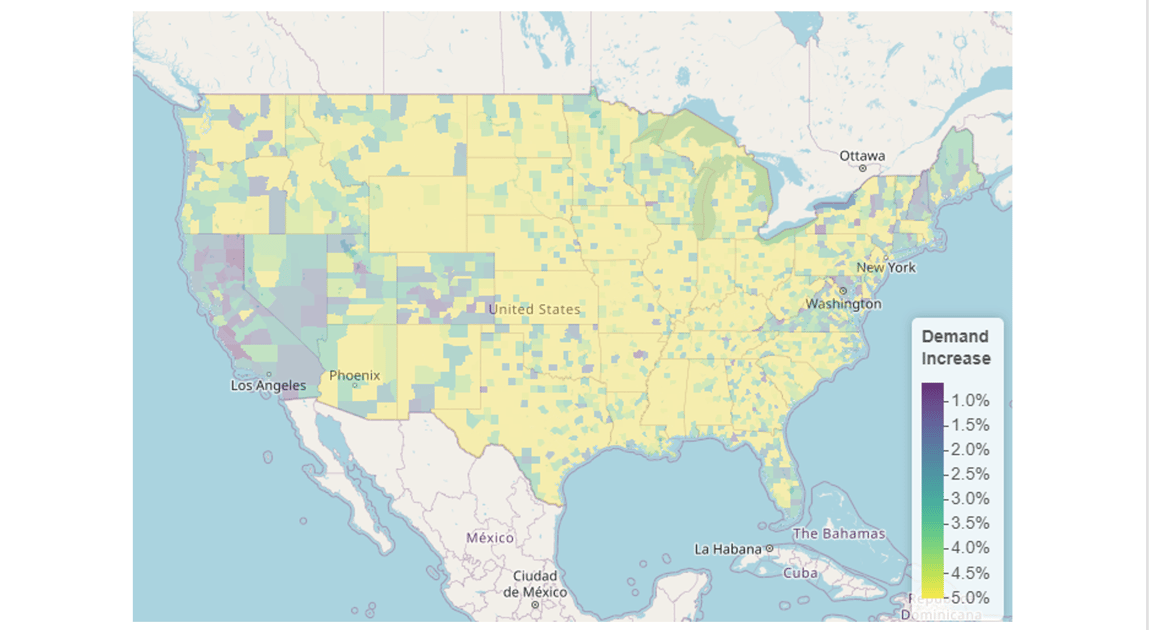

Summit Releases Infrastructure Investment White Paper

November 29, 2017 •Eva Palmer

.png?height=630&name=Untitled%20design%20(21).png)

.png?height=630&name=Untitled%20design%20(20).png)