The Biden Plan: Where Will the New Tax Credit Have the Most Impact?

January 27, 2021 •Jacob Trout

As we talked about in our previous post, the Biden campaign has proposed a first-time home buyer (FTHB) tax credit of up to $15,000, which will function as a true markdown in the price of a house.

Next, we can examine the potential variation in regional impacts via a methodology utilized by Mark Keightley, PhD, an economist at the Congressional Research Service. Keightley performed an analysis of the previous FTHB tax credit that was part of the American Recovery and Reinvestment Act of 2009. He used median home price data in conjunction with estimates of price elasticity of demand—the relationship between house prices and demand for housing—to forecast growth in housing demand.

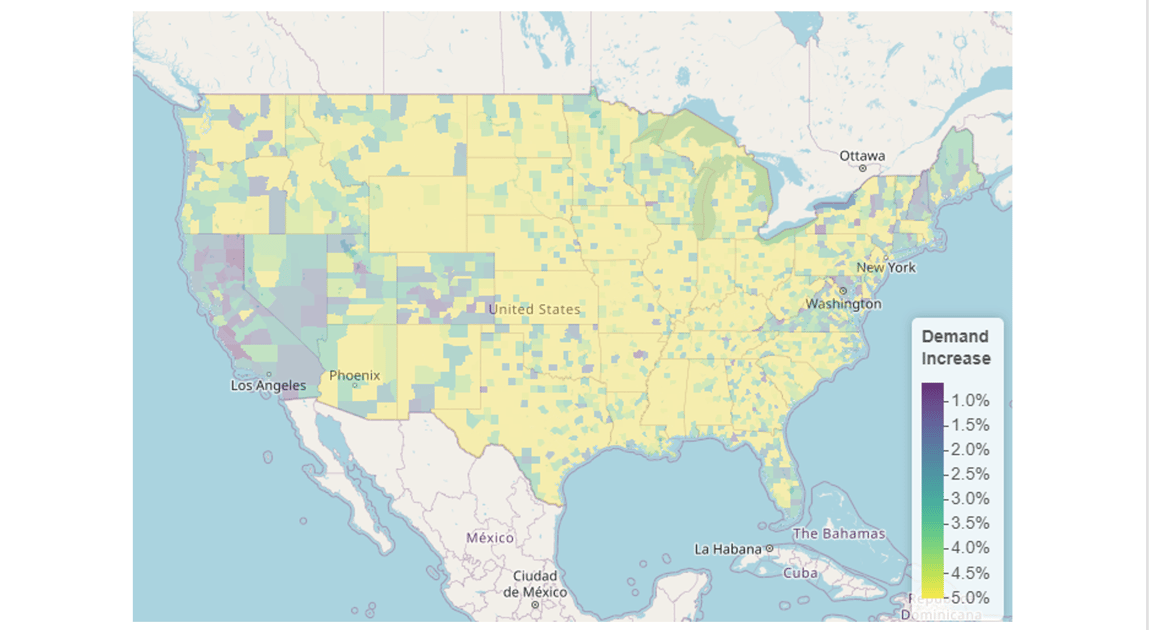

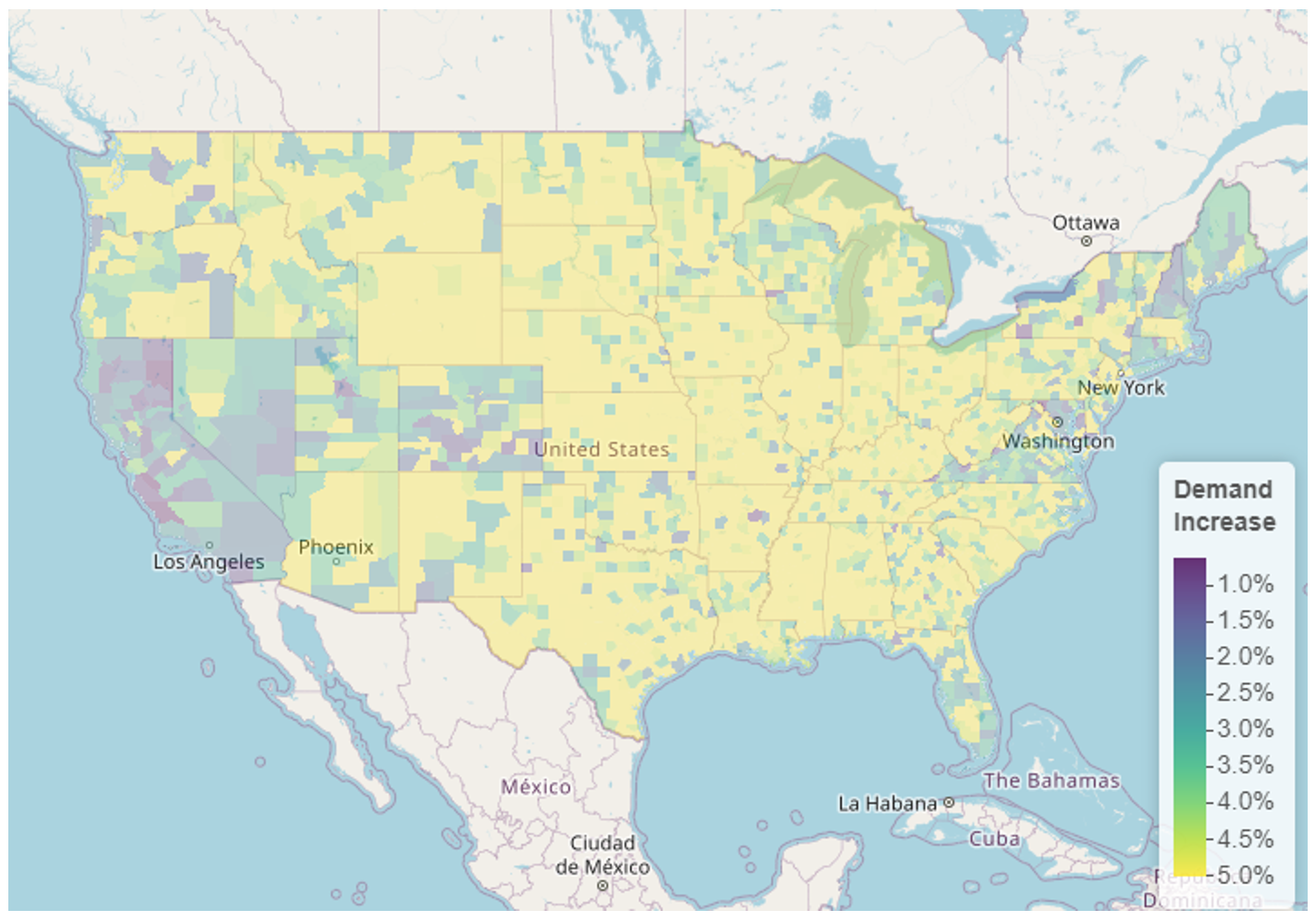

To get a sense of where demand for housing will increase the most with the tax credit, we have applied this methodology across all counties in the U.S. where data was available. The methodology has several assumptions, which are important to note. First, it assumes that first-time home buyers and repeat home buyers are approximately the same in their decision-making. Additionally, it assumes that the price elasticity of demand for housing is uniform across the country, estimated at -0.5. (When the price elasticity of demand is -.5, a price reduction of 10% will solicit a 5% growth in quantity demanded.) Upon conducting our analysis, we find the average home price reduction due to the anticipated FTHB tax credit in each county. Then, by taking the percentage decrease in price and multiplying by the price elasticity of demand for housing in the United States, we get the projected demand quantity increase in percentage points. The projected demand increase for each county is displayed below.

Projected Housing Demand Increase by County

Our analysis projects that a majority of counties (60.3%) in the U.S. will experience a 5% growth in housing demand. Given our assumption of price elasticity of demand for housing, this is the maximum demand stimulate possible. (When the price elasticity of demand is -.5, a price reduction of 10% will solicit a 5% growth in quantity demanded.) However, these counties only account for 18.5% of the population. Approximately 80% of the population—265 million Americans—live in the remaining 39.7% of counties, where the median home price is greater than $150,000 and the tax credit will make less of an impact.

In counties where the tax credit reduces the purchase price of a home by less than 10%, we see more muted effects on housing demand forecasts: an average demand growth of 3.69%. Furthermore, in the top 10% of most populated counties, the projected increase in demand is even smaller, at 2.9%.

Projected Housing Demand Increase by County Population

| County Population | Median Estimated Housing Demand Increase | Median Home Price |

| Less than 10,939 | 5.0% | $99,240 |

| 10,939–25,673 | 5.0% | $112,188 |

| 25,673–67,580 | 5.0% | $131,817 |

| Greater than 67,580 | 3.7% | $202,308 |

| Greater than 213,787 | 2.9% | $258,604 |

How Can We Make Biden’s Tax Credit More Equitable?

Ultimately, these findings conform to our basic understanding of the housing market. Most Americans live in urban or semi-urban environments where, due to the dense and crowded nature of the geography, house prices are relatively high. These high prices weaken the benefit of a FTHB tax credit capped at $15,000, because it represents a lower subsidy for potential home buyers.

This analysis suggests that homeownership will become more accessible in rural areas than urban and suburban ones with this FTHB tax credit. The $15,000 credit is less effective for first-time home buyers in markets where the median home price is greater than $150,000. A potential solution is to remove the cap and set the tax credit equal to 10% of a home’s purchase price. This change would almost certainly raise concerns about the costs of the program, but policy makers could apply other conditions to minimize costs while equitably promoting homeownership across the country. For example, imposing a maximum home value can prevent use of the tax credit on very expensive homes. Additionally, a borrower income ceiling can better target first-time home buyers. With such conditions, rather than a hard cap on the credit amount, the Biden administration can more equitably distribute the tax credit across the country’s various housing markets.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)