How Does Summit Detect Discrimination in Mortgage Lending? A Three-Part Series

January 7, 2021 •Michael Easterly

With contributions by Natalie Patten

Today’s post kicks off a three-part series on discrimination in mortgage lending and the analytical techniques that Summit Consulting uses to detect it. We use Home Mortgage Disclosure Act (HMDA) data, internal data from banks, and underwriting documents to detect and estimate potential predatory-lending practices for our clients.

- In this installment, we discuss analytical techniques to detect redlining, the practice of denying loan applications to minority applicants based on the racial composition of neighborhoods.

- Part two examines loan pricing discrimination, the practice of charging higher interest rates to minority applicants based on their race.

- Part three covers origination discrimination and predatory lending, the practices of denying mortgage loans to minority applicants based on race and giving minorities riskier loan terms, respectively.

Summit has supported investigations for the U.S. Department of Housing and Urban Development (HUD) and the Consumer Financial Protection Bureau (CFPB) since 2012.

Our comprehensive fair-lending analyses include:

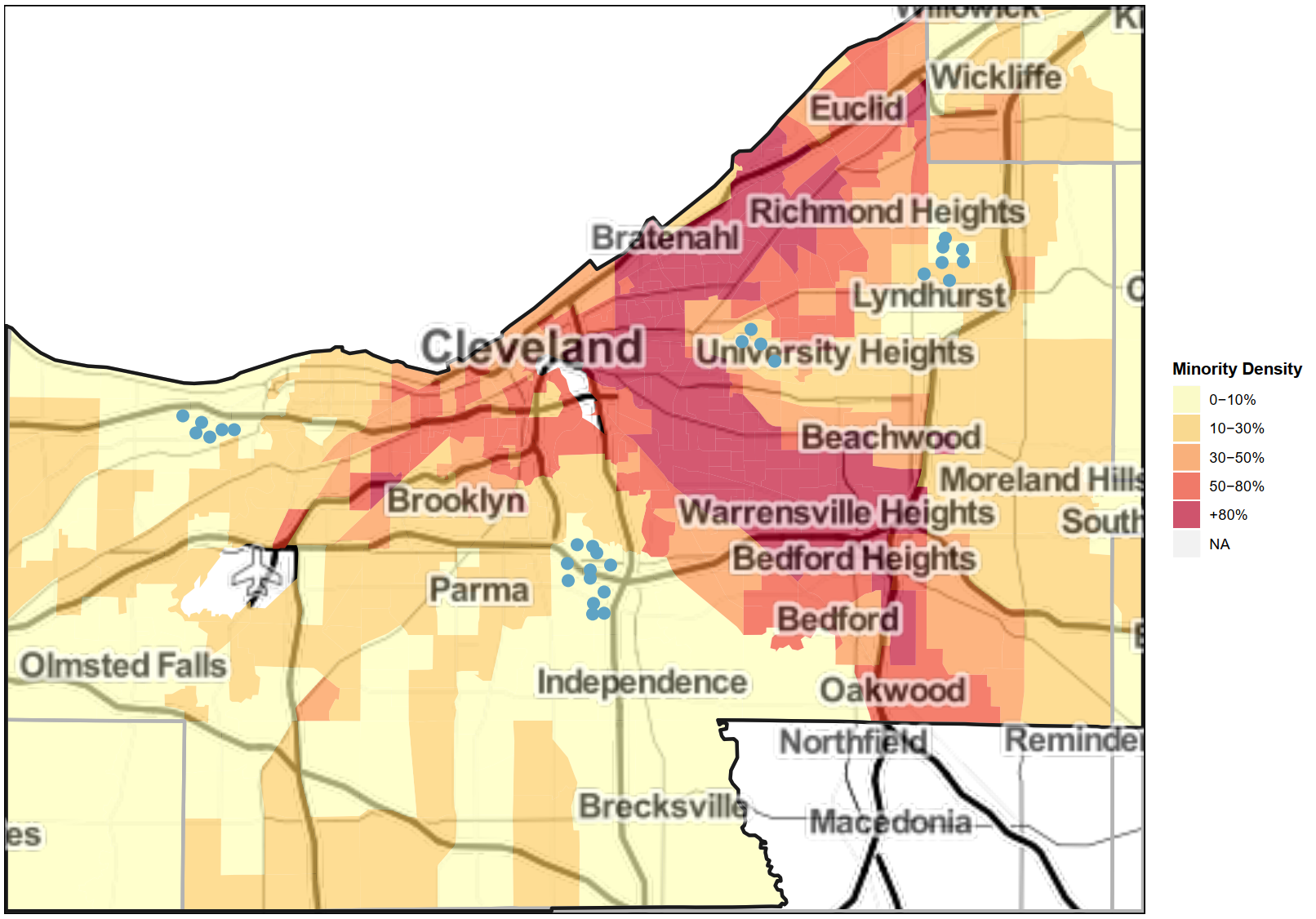

- Data visualizations: Maps, graphs, and tables that show the presence and severity of redlining practices, like the map below

- Peer-institution comparisons: Identifying and comparing lending outcomes for lending institutions of similar size in the same geographic area as the target lender (that is, the lender that may be practicing discriminatory behavior)

- Statistical tests and regression analyses: Controlling for the effects of other borrower characteristics (debt-to-income ratios, credit scores, etc.) to isolate the effect that the borrower’s race had on lending outcomes

- Statistical matching: Matching minority borrowers to white borrowers with otherwise similar characteristics (for example, income and age) and comparing lending outcomes

How Does Summit Detect Redlining?

Redlining is the discriminatory practice of denying or restricting credit to applicants based on the racial composition of the neighborhood where they want to buy a home. In other words, lending institutions practicing redlining deny loans in neighborhoods with a high percentage of minorities, even when applicants are creditworthy. While it was once a formal policy of private-sector lenders and the federal government, Congress outlawed redlining as part of the Fair Housing Act of 1968. Nevertheless, it persists today, usually in more subtle forms.

Data Visualization

In the example map below, we show properties for which a hypothetical lending institution in the Cleveland metropolitan statistical area (MSA) approved loans. This lender appears to be engaging in redlining because most of the properties, shown as blue circles, are in neighborhoods with low minority populations (those with yellow or light orange shading). Although this map does not confirm that this lender is redlining minority neighborhoods, it does provide preliminary indications of redlining that should be explored further. We would then perform additional analyses to confirm the existence of redlining.

Peer-Institution Comparisons

We conduct peer-institution comparisons to determine whether the lending institution we are investigating is unique in its alleged discriminatory behavior. If its peers have similar outcomes, this may indicate that there is a geographical pattern, such as a limited number of houses for sale in many high-minority neighborhoods, or other nonracial explanations for the origination patterns.

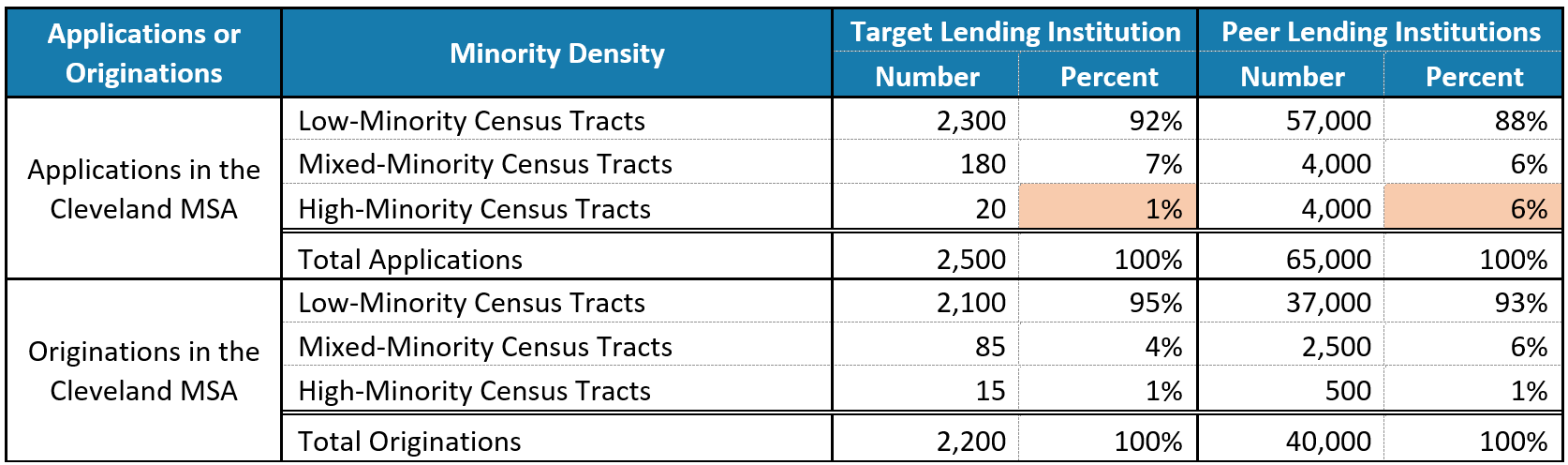

We identify peer lending institutions that are in the same geographic area and similar in size and lending capacity. First, we compare loan applications and originations in each minority density grouping (both low-minority and high-minority census tracts). Shortfalls in applications in high-minority areas relative to their peers may indicate that the lending institution’s marketing or business development teams are following discriminatory practices (for example, the lender does not market in high-minority neighborhoods). Shortfalls in originations in these neighborhoods compared to their peers may indicate that redlining is occurring in the approval process.

The table below shows that the hypothetical lender tends to receive fewer applications in high-minority census tracts than its peer lending institutions. This corresponds to a shortfall of 134 loan applications in high-minority census tracts. Therefore, we might conduct further analyses on nonracial neighborhood characteristics, such as income, that might explain why this institution does not lend in these areas. We might also encourage our client to investigate the lending institution’s marketing strategies.

Example of a Peer-Institution Comparison

In part two next Thursday, we’ll examine loan pricing discrimination, the practice of charging higher interest rates to minority applicants based on their race.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)