How a HECM Reverse Mortgage Loan Works

March 13, 2017 •Edward Seiler, Ph.D.

On November 15, 2016, the U.S. Department of Housing and Urban Development (HUD) published the Actuarial Review of the Federal Housing Administration Mutual Mortgage Insurance Fund HECM Loans for Fiscal Year 2016. This review, prepared by HUD's independent actuary, contained several major methodological changes from the previous (FY 2015) version of the review. Those changes resulted in the economic value of the HECM portion of the Mutual Mortgage Insurance Fund (MMIF) falling to negative $7.7 billion from positive $6.8 billion the year before.

In these blog posts, two of Summit’s housing experts—Dr. Edward Seiler and Andrew Netter—provide an overview of the HECM reverse mortgage program and its mechanics and summarize the drivers of the changes between the 2015 and 2016 HECM Actuarial Reviews.

What is the life cycle of a HECM loan?

In our last blog post, we provided an overview of HUD’s Federal Housing Administration (FHA) Home Equity Conversion Mortgage (HECM) program with a focus on the program’s origins and how it’s changed over the years. In this blog, we describe the mechanics of how HECM loans work.

To be eligible for a HECM reverse mortgage loan, the borrower must meet the following criteria:

- Be 62 or older

- Own the property outright or have a mortgage that can be paid off with the HECM proceeds

- Occupy the property as a principal residence

- Have no past delinquencies on any Federal debt

- Complete HECM counseling

The maximum loan amount for a HECM is a function of two factors: the principal limit factors (PLF) and the maximum claim amount (MCA). The HECM originator establishes the PLF and MCA at loan origination, and they do not change over the life of the loan.

- The MCA is the appraised value of the home at loan origination capped at the FHA mortgage limit at the time of origination

- The PLF is the percent of the MCA that the borrower(s) can draw. It is based on the age of the youngest borrower and interest rates at origination

PLFs increase with borrower age at origination and decrease with interest rates at origination. The product of the PLF and the MCA is the initial principal limit. The amount the borrower is eligible to withdraw is the net principal limit, which accounts for loan proceeds used to satisfy other debts and obligations, including existing liens, closing costs, and set asides.

A HECM terminates when one of the following occurs:

- The borrower pays off the loan or refinances the HECM into a new loan

- The last remaining HECM borrower dies

- The borrower sells or transfers the property

- The property ceases to be the borrower’s primary residence for 12 consecutive months

In the latter two cases, we may call the termination a mobility termination or, if the borrower moves into a dependent care facility, a morbidity termination. Moreover, a HECM can terminate when the borrower defaults under the terms of the mortgage. Borrowers can default for several reasons, including not maintaining homeowner’s insurance, not performing required maintenance, and not paying property taxes.

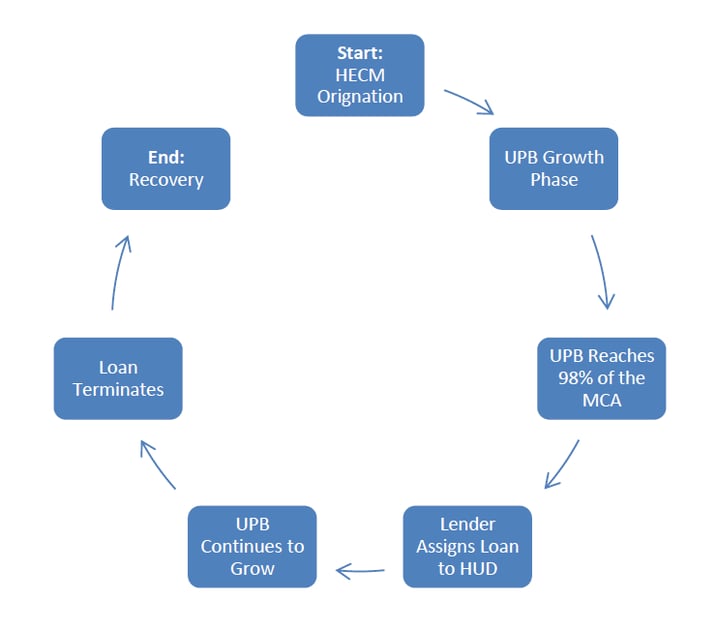

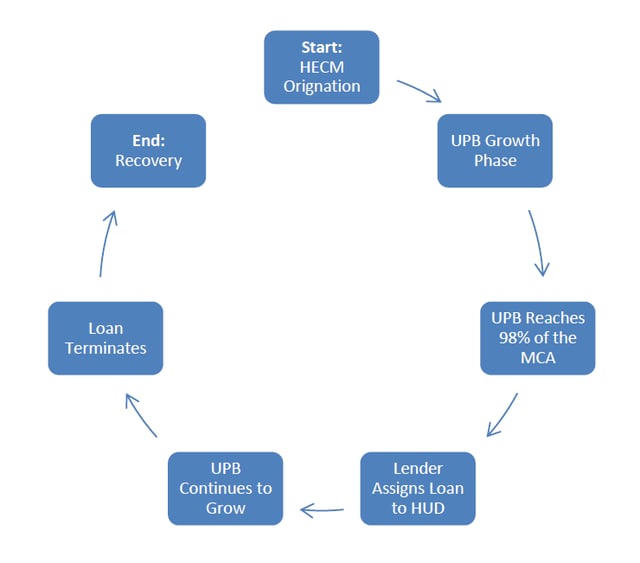

A lender may file a claim to FHA for losses up to the MCA of each HECM. There are two such claim types:

- Claim Type 1: FHA, as insurer of the HECM program, reimburses HECM lenders for deficiencies that occur when the property supporting the HECM terminates prior to assignment and the proceeds of the sale are insufficient to cover the unpaid principal balance (UPB) of the loan.

- Claim Type 2: Occurs when a lender assigns a loan to HUD. Two types of assignments can occur:

- When the UPB reaches, or exceeds 98% of the MCA, the lender/servicer makes a claim to FHA for the minimum of the UPB and the MCA in exchange for the property. This is the most common type of assignment.

- A demand assignment occurs when the lender or servicer of the HECM is no longer able to service the HECM and FHA requires assignment of the note.

At assignment, HUD purchases the loan from the lender for the minimum of the loan’s UPB and the MCA, and becomes the note-holder and servicer of the loan. The loan continues to accrue interest and MIP until loan termination. FHA pays all fees, cash draws, and other cash outflows monthly. Upon termination of the loan, the UPB is due and payable. This obligation can be satisfied by selling the home and remitting the net sales proceeds to HUD, even if less than the UPB, or by conveying the home to HUD. The borrower’s estate can also “purchase” the home for 95% of the appraised value.

We can summarize the lifecycle of a HECM that survives through assignment as follows:

Now that we’re armed with information about what the HECM is, in the next blog post, we’ll discuss some of the factors that drove changes in the HECM portfolio valuation between FY15 and FY16.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)