Opportunity Zones Revisited: Could Legislative Changes Drive Greater Investor Adoption?

May 4, 2021 •Jonathan Ewert, CapZone Impact Investments

With contributions by Auyon Rahman and James Hargens of Summit Consulting

This is the first in a series of three blog posts in collaboration with CapZone Impact Investments discussing Opportunity Zones. In this post, we’ll explain what they are, provide an overview of recent legislative and regulatory changes to the program, and look at how these changes might impact interest in Opportunity Zone investments. In the second post, we’ll discuss how the Opportunity Zone incentive aligns with the Biden administration’s Build Back Better Plan. And in the third and final post, we’ll take a look at opportunities for Community Development Financial Institution (CDFI) participation in the Opportunity Zone space going forward.

Disclaimer: The information in this article is for informational purposes only and should not be construed as investment advice or be relied upon to make any investment decisions.

|

What is an Opportunity Zone? The Opportunity Zone tax incentive offers investors a deferral of federal tax payments on realized capital gains by reinvesting those capital gains into designated low-income communities. |

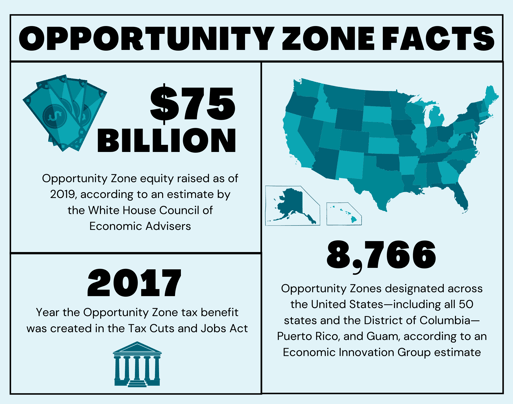

Since its inclusion in the Tax Cuts and Jobs Act of 2017, the Opportunity Zone (OZ) tax benefit has undergone several regulatory updates. In previous blog posts, Summit provided an overview of Opportunity Zones and the legislation and broke down the proposed regulations published by the Internal Revenue Service (IRS) in October 2018. The final regulations, which were released in December 2019, addressed many comments received in response to the proposed regulations and provided clarity to community development professionals and investors on key items.

Opportunity Zone COVID Relief

In response to the COVID-19 pandemic, the U.S. Department of the Treasury and the IRS have issued three sets of regulatory notices that extended OZ deadlines for investors and Qualified Opportunity Fund (QOF) activity. The first extensions, covering investment windows and testing period exemptions, expired on March 31, 2021. The second set extends working capital requirements for Qualified Opportunity Zone Businesses (QOZB), allowing these businesses additional time to invest OZ capital in their property, and also extends reinvestment periods for QOFs until June 30, 2021. Finally, on April 14, 2021, Treasury published a proposed rule focused on providing additional deadline flexibility in disaster areas as well as establishing eligibility certificate requirements for certain foreign investors.

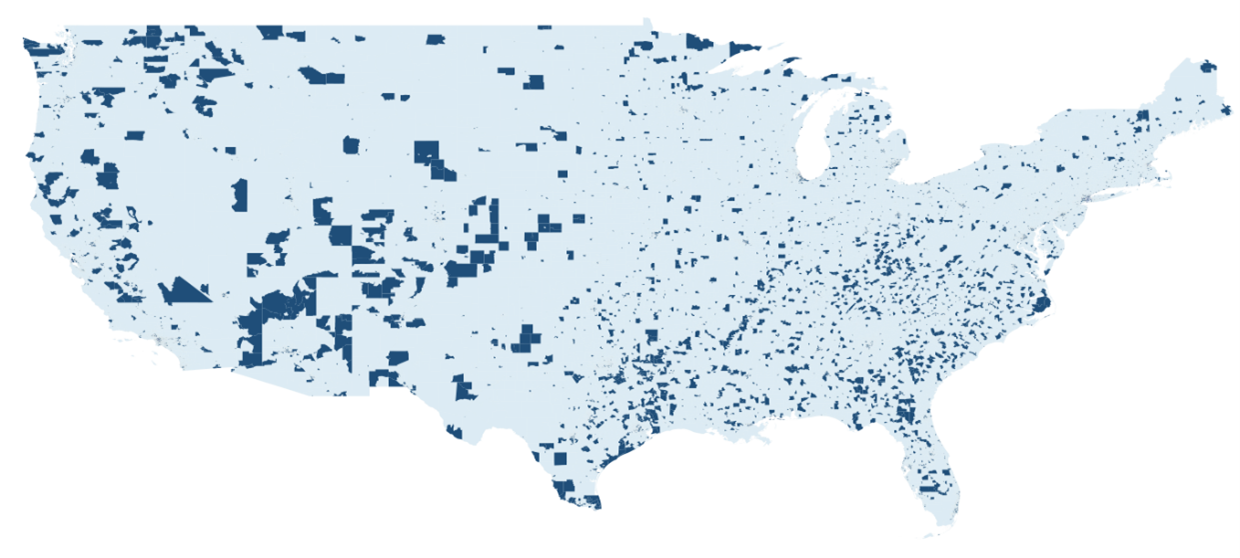

Opportunity Zone designated census tracts

Opportunity Zone designated census tracts

Source: U.S. Department of Housing and Urban Development data

The Immediate Policy Horizon

Originally conceived during the Obama administration, OZs have transcended partisan debate and received support under subsequent administrations. In addition to Federal support, OZs remain one of the very few tax policies that continue to be bolstered by U.S. mayors and governors—regardless of political party, voter demographics, or economic profile.

Currently, there are two key pieces of legislation that are in committee and likely to emerge for a vote in 2021. First is the IMPACT Act, which calls for expanded reporting requirements and impact tracking for OZs across the country. If passed, these additional requirements would enhance information collected from QOFs in their annual tax filings. Treasury would also be required to make the data available to the public and publish comprehensive OZ community impact reports. While increased reporting requirements (particularly for tax benefits) might slow investor participation initially, they are a signal that the OZ program is gaining more attention and traction among a wider group of legislators and stakeholders and should provide investors with increased confidence in the program.

The second piece of legislation expected to come to the floor in 2021 is the Opportunity Zones Extension Act of 2021. The statute currently allows investors to defer taxes on eligible capital gains invested in OZs through QOFs until the end of 2026, and this legislation extends that deferral date until the end of 2028.

|

Increased reporting requirements […] are a signal that the OZ program is gaining more attention and traction among a wider group of legislators and stakeholders. |

In addition to these legislative developments, the Biden administration has recognized OZs as a key program in advancing economic and racial equality, which we will cover in the next post of this series. U.S. Secretary of Transportation Pete Buttigieg has already included funding preference for projects located in OZs in the $889 million Infrastructure for Rebuilding America grant program. When coupled with the potential involvement of Community Development Financial Institutions in OZ projects, it becomes evident how far the program has come since 2017 and increases the likelihood that additional federal support is on the way.

Opportunity Zone Structuring for Investor Benefit

Almost 8,800 communities across America can benefit from the private capital flows that the OZ incentive stimulates. While a tax incentive can never turn a bad investment into a good one, it can make a good one great. When OZ equity is added to other forms of investment, such as traditional private equity, bank debt, federal and state grants, and low-cost loan programs available to QOZBs, the investor returns can be supercharged.

However, some investors consider OZ investing too risky. As the global pandemic has taught us, no investment sector is immune from risk. For many investors, commercial real estate has been a go-to for decades, but even that sector had significant liquidity and volatility risk over the last 12 months. The right OZ investing strategy can help manage these areas of risk; a smart strategy controls for liquidity risk so that investors can plan to exit an investment early, even if they will not receive the maximum tax abatement and exclusion benefits.

A “Virtuous Circle” on the Horizon

While there is bipartisan support for the OZ tax incentive, tax policy on Washington whiteboards doesn’t always translate into rapid investor adoption. In this case, though, QOF formation has accelerated despite several factors—a global pandemic, a change of administration, persistent racial and social inequities, and a polarized electorate—any one of which would normally stifle a new asset class. Novogradac, a specialist accounting firm that tracks third-party OZ fund formation and capital flows, estimated that as of April 2020, $10 billion had been raised by third-party or managed QOFs. During the same period, the White House Council of Economic Advisers published a report that included Novogradac’s data in their analysis, which estimated that $75 billion had been raised by the end of 2019. From $0 to $75 billion in two years is an extraordinary speed for capital formation in a new asset class under any circumstances, even the most favorable. This kind of rapid investor adoption doesn’t happen by accident; it needs investor confidence and market momentum.

|

From $0 to $75 billion in two years is an extraordinary speed for capital formation in a new asset class under any circumstances, even the most favorable. |

The emerging OZ asset class is also large. With an estimated $6 trillion of unrealized capital gains on individual and corporate balance sheets in the U.S., OZs have the potential to become approximately twice as large as today’s municipal bond market, which took 200 years to achieve $3 trillion in size. In addition to political momentum, OZs are benefiting from the growth of ESG investing, a $34 trillion global megatrend, as OZs are included in that investment class. The OZ tax incentive focuses private investment in communities that need it most, amplifying the impact of Federal and state funding programs in these communities, which in turn can increase returns and create the “virtuous circle,” or positive feedback loop, that investors look for.

As a new tax policy that continues to generate investor appetite, OZs could become a catalyst for community transformation that matches the values of the investor to the value of the investment. The potential role of OZs as a vehicle to drive broader policy goals within an ESG framework will be the subject of our second post in this series, within a broader discussion of President Biden’s Build Back Better plan. Stay tuned!

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)