Evaluating Potential Mission-Related Investments: Credit Risk Analysis

April 11, 2018 •Joseph Bateman

In the second post of our Mission-Oriented Finance blog series, we discuss evaluating credit risk of potential investments. In Part 2 of this blog, to be published on Thursday, April 12, we discuss evaluating impact and alignment with mission for potential investments.

Summit works closely with clients to understand their risk appetite and credit policies long before evaluating credit risk of any potential investment. Investors maintain different credit risk appetites, ranging from highly risk adverse to more tolerant types of investment. Some federal credit programs, like the U.S. Department of the Treasury’s Bond Guarantee (BG) Program, receive no Congressional appropriations to cover potential losses within their loan program (known as a zero-credit subsidy program). As such, the BG Program stringently underwrites prospective borrowers utilizing high credit standards, taking very little credit risk. Conversely, some philanthropic investors, which may have a higher tolerance for credit losses, may be more willing to invest in higher-risk projects or borrowers. Fully understanding the risk appetite of the investor orients the credit evaluation and approval process.

Regardless of risk orientation, mission-oriented investors typically evaluate and quantify credit risk, assessing prospective borrowers to effectively calculate risk within their overall portfolio. Summit provides services that include comprehensive underwriting, credit analyses, onsite due diligence, and reports that document the analysis in a detailed credit memo prepared for the Credit/Investment Committee. For some clients establishing new lending programs or who might be new to the investment space, Summit facilitates thinking through and establishing new credit policies and underwriting procedures to formalize credit risk analysis within their lending and investment programs.

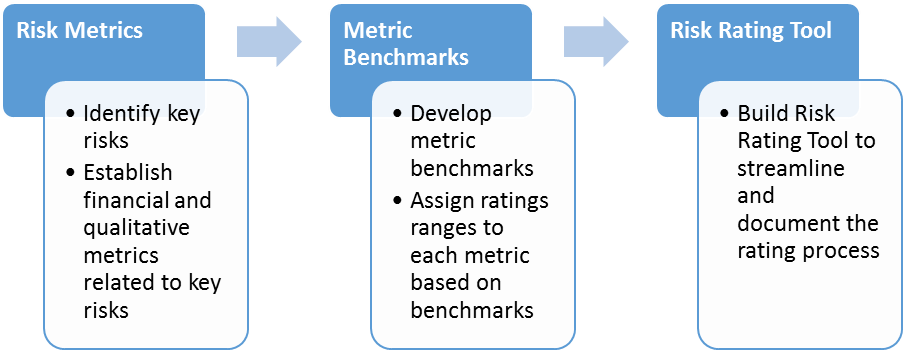

Summit frequently develops customized risk-rating methodologies, including risk-rating tools, to identify credit and portfolio risks unique to each mission-oriented investor. Click here for a recent podcast devoted to Summit’s Risk Rating Tool methodologies for individual credit and portfolio risk analysis. Summit recognizes that each mission-oriented investor maintains a unique portfolio composition, whether due to focused investment in specific asset classes, geography, or key risks subject to specific governmental regulations. Summit utilizes a range of methodologies and approaches in assessing credit risk and building customized risk rating tools. These risk rating tools can be customized so that a specific score correlates with a specific probability of default. Summit’s tools can also estimate the expected recovery on a defaulted asset. Inputs into these tools could be historical financial performance, macroeconomic factors, projected financial performance, management capacity, and other qualitative and quantitative factors. The initial output of the risk rating tool is then notched, or adjusted, up or down based on a detailed quantitative and qualitative evaluation of credit risk to arrive at a final score. Figure 1 shows Summit’s process for developing a customized risk rating tool.

Figure 1: Risk Rating Tool Development Methodology

Summit’s data-driven risk rating methodologies serve as one important input into the credit underwriting process, but Summit’s approach also includes a detailed qualitative evaluation of other aspects of a potential investment, as appropriate for the given asset class or the investor’s risk appetite. Summit works closely with clients to develop a highly detailed analysis or a summary recommendation document reporting on high level information, as dictated by the client, to assist in the investment decision-making process.

For mission-related investors, Summit often integrates a full analysis of the potential investment’s alignment with the investor’s mission as well as an analysis of the investment’s potential impact. The next blog in this series will focus specifically on this aspect of Summit’s approach to evaluating potential mission-related investments.

For more information on Summit's mission-oriented finance work, please contact Summit Director Susan Newton-Rhodes or Senior Manager Ian Weise.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)