The New Economic Struggles of Single-Family Home Borrowers (Part 1 of 2)

May 2, 2022 •Nathan Williams

With contributions by Angela Peterson

This is the first of a two-part series on the struggles that single-family home borrowers are currently facing. This post explores the economic impacts experienced by borrowers of the Single-Family Housing Guaranteed Loan Program in more detail. In the second post, we’ll discuss tools that can help mitigate these negative impacts in the future.

Introduction

The COVID-19 pandemic has negatively affected the economic status of many people in the United States, and these negative effects persist as the country readjusts under fluctuating health, economic, and inflationary circumstances. In 2021, the U.S. Department of Agriculture’s (USDA’s) Rural Development implemented large-scale mortgage recovery advances (MRAs) to support troubled borrowers under its Single-Family Housing Guaranteed Loan Program (SFHGLP). The program is intended to help provide affordable housing to rural homeowners across the country. However, borrowers are still struggling to keep up with their mortgage payments. Since the MRAs were distributed in 2021, inflation has reached its highest level since 1981. In addition, both housing and mortgage prices are continuing to rise, constricting borrowers’ financial resources. Some homeowners that are part of the SFHGLP will not be able to keep up with their payments, leaving the USDA with the challenge of an influx of delinquencies.

The MRA Initiative and the COVID-19 Economy

A mortgage recovery advance, or MRA, is a onetime payment intended to help bring a delinquent loan back to current status (a loan becomes current when all past-due balances are paid off). The USDA’s MRA initiative was implemented in 2021 to help cover past-due mortgage payments and related costs of borrowers in the SFHGLP. This onetime subsidy payment was coupled with two other COVID-19 relief measures: interest-rate reduction and loan-term extension. A White House publication on July 23, 2021, “Fact Sheet: Biden Administration Announces Additional Actions to Prevent Foreclosures,” mentioned this plan by the USDA, stating that when a combination of loan rate reduction and term extension is not enough to achieve a 20% payment reduction, borrowers will also receive a mortgage recovery advance.

Macroeconomic trends originating in the first quarter of 2020, such as a drop in mortgage rates and the federal funds rate and a rise in housing prices and the Consumer Price Index (CPI), can illustrate the financial impacts on single-family homeowners under the USDA-managed program. The following trends show how borrowers who initially benefited from the MRA initiative may now be struggling to stay current on their loans. While economic data is not directly available for borrowers in this program, we can compare sets of broader economic data to represent what that data might look like.

By separating economic trends from Q1 2020 and Q2 2021, we can distinguish what changed during each phase, both before and after the MRAs, which took place in mid-2021. Through examining both time periods separately, we can see what these driving factors are and identify any divergence occurring at this point in time, helping to show where mitigation tools are needed.

The Rising Prices of Houses Sold in the United States

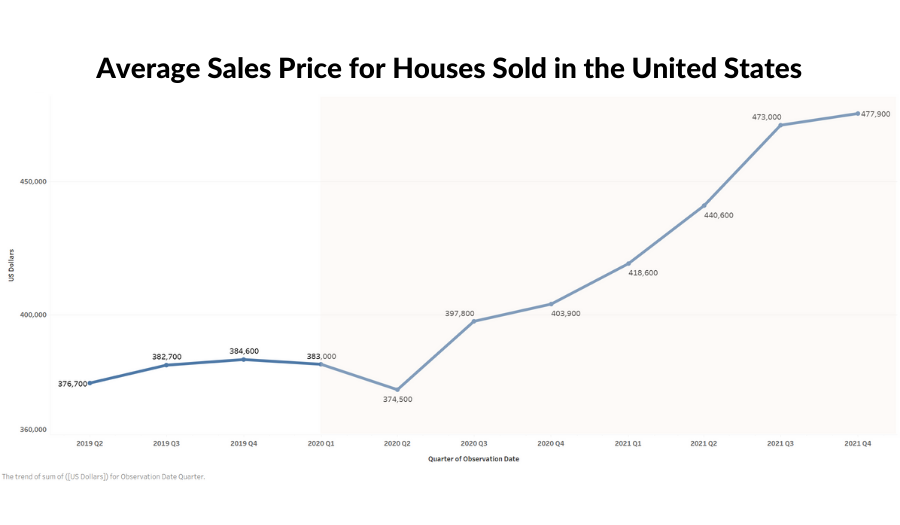

Figure 1 below displays the Average Sales Price of Houses Sold for the United States, according to the St. Louis Federal Reserve Economic Data as of April 10. Since Q1 2020, this figure has risen from $383,000 to $477,900 in Q4 2021, a nominal change of $94,900 and a magnitude change of 24.78%.

Figure 1

This increase in housing prices, led in part by an initial stagnation in housing construction and supply-chain issues, impacts the amount of debt a borrower must take on in the lending program. More debt, meaning a higher overall loan amount, and higher mortgage payments may negatively impact the borrower’s ability to stay current on the loan given the same income level. The next set of data we’ll examine has also contributed to the rise in housing prices.

The U.S. 30-Year Fixed-Rate Mortgage Average

Figure 2 below displays the 30-Year Fixed Rate Mortgage Average in the United States, according to the St. Louis Federal Reserve Economic Data as of April 10.

Figure 2

From December 26, 2019, until June 3, 2021, the 30-year fixed-rate mortgage average in the U.S. decreased from 3.74% to 2.99%, a nominal decrease of 0.75 percentage points and a magnitude decrease of 20.05%. From June 3, 2021, until April 7, 2022, this fixed-rate mortgage increased from 2.99% to 4.72%, a nominal increase of 1.73 percentage points and a magnitude increase of 57.86%. We see two directional shifts between the date ranges mentioned. The second phase, starting from mid-2021 when the MRA initiative was implemented until almost the present day, shows a considerable increase. This data was chosen given that the SFHGLP utilizes these 30-year fixed rates when loans are made. With such an increase, mortgage interest payments will increase for borrowers, making it more difficult to stay current on their loan given the same income level.

The SFHGLP borrowers directly impacted by the macroeconomic trends mentioned above may also suffer from a decrease in buying power influenced by the increase in CPI. Seasonally adjusted, the CPI for all urban consumers, written as a percent change from a year ago, rose from 0.24% in May 2020 to 8.56% in March 2022. In context, the current rate of 8.56% is the highest 12-month increase since 1981. Given that the requirements for the SFHGLP cap the income of eligible borrowers at 115% of median household income, an increase in wages above that threshold would not help potential applicants as much as anticipated.

Conclusion

Borrowers under the SFHGLP have faced a multitude of changing macroeconomic factors in the last 2 years, even more so since the MRA initiative was implemented in mid-2021. Collectively, these factors mean that it’s more difficult for these individuals to stay current on their loans and in their homes. The USDA would benefit greatly from tools intended to help forecast the anticipated economic effects on borrowers and implementing loss mitigation techniques, ultimately keeping more people in their homes. In the second part of this series, we’ll discuss two major tools that focus on loss mitigation for these types of lending programs.

Tableau graphs by Nathan Williams

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)