Summer Intern Series: Bank Rank with Jacob Ledbetter

August 14, 2015 •Melissa Cichantek

* Welcome to the fourth post in Summit's 2015 Summer Intern Series! See below for Summer Analyst Jacob Ledbetter’s essay. Click here to learn more about our Summer Analyst/Associate program. *

One year ago, I moved out of Alabama for the first time and quickly realized that I would not be able to keep banking at the local credit union where I opened an account when I was a kid. As I began searching for another bank, I discovered that there was no hub for banking information that took into account the consumer’s experience. Several online rating systems focus primarily on metrics such as the interest rate offered by the bank. However, with current interest rates near zero, income from checking account interest amounts to only a couple dollars each year. Why would a consumer make such a large decision based on this small amount of money?

To combat this issue, I pinpointed five metrics to quantify customer banking experiences and identified sources which spoke to each of these topics:

- Convenience: Number of branches by ZIP code, taken from a Data.Gov database

- Fundamental Confidence: 5-Star Rating from BankRate.com based on a bank’s capital adequacy, asset quality, profitability, and liquidity

- Consumer Complaints: Number of complaints registered with the Consumer Finance Protection Bureau, by branch location

- Employee Friendliness: Rating of the bank by its employees from Glassdoor.com

- Twitter Chatter: Sentiment analysis score based on tweets about the bank, gathered using Python

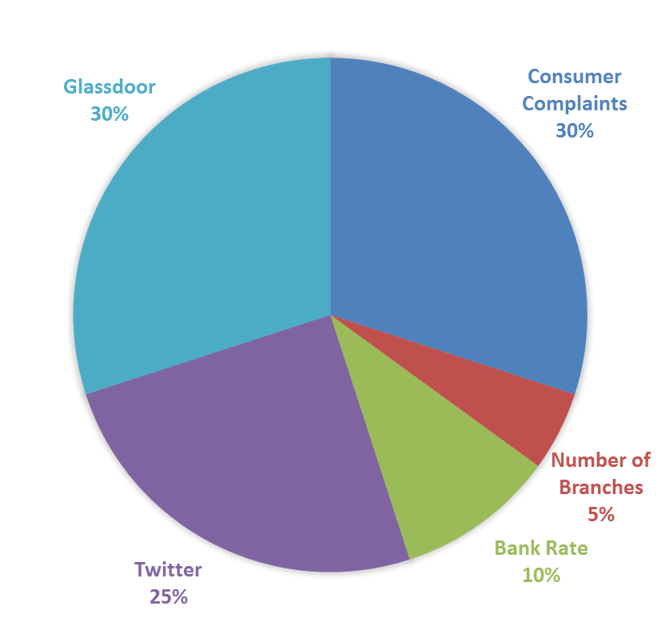

After gathering the data, I combined these five metrics based on specific weights to create an index by which to judge each bank. Each bank’s score is a weighted sum of the scores they got in each category:

- First, I standardized units by setting each category’s score to a percentage of the max value of that category.

- Second, I multiplied each category’s score by the category’s weight before adding scores from different categories together for possible total of 7 points. Each category was added as a positive value, except for Consumer Complaints, which could subtract at most three points from the score.

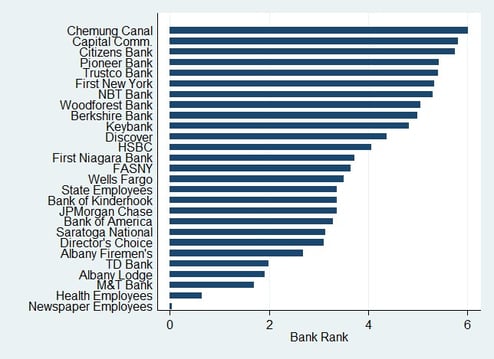

To test this ranking system, I looked at the 26 banks and credit unions in Albany, New York and generated the index value for each institution. The ranking clearly delimits the differences among banks based on their scores, solving the information problem among consumers. This type of consumer-focused ranking system could offer a better way to find a bank that best fits each person’s need.

[1] Hutto, C.J. & Gilbert, E.E. (2014). VADER: A Parsimonious Rule-based Model for Sentiment Analysis of Social Media Text. Eighth International Conference on Weblogs and Social Media (ICWSM-14). Ann Arbor, MI, June 2014. http://comp.social.gatech.edu/papers/icwsm14.vader.hutto.pdf.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)