Pathways to Entrepreneurship: Personal and City Predictors of Self-Employment

June 6, 2017 •China Layne

Last week, I presented my study, “Pathways to Entrepreneurship: Personal and City Predictors of Self-Employment,” at the 2017 Annual Conference of the Labor and Employment Relations Association.

In May 2017, 10% of American workers were self-employed. Self-employment can be in a non-incorporated (e.g., sole proprietorship) or incorporated business, with a formalized ownership and legal structure that confers certain liability and tax advantages as well as the ability to raise capital through selling securities. Most self-employment is in non-incorporated businesses. In May 2017, 62% of self-employed workers had a non-incorporated business.

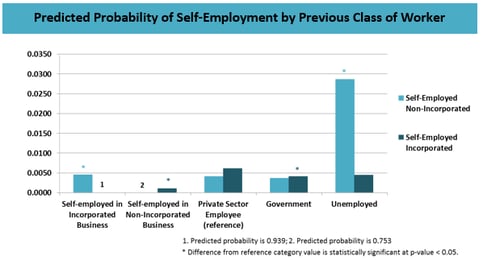

A long-standing theory to explain why workers pursue self-employment is the “push” hypothesis, namely, that unemployment prompts people into self-employment. For instance, Rissman found that young, male workers entered self-employment in response to increasing unemployment and exited self-employment during periods of economic expansion.

To test this hypothesis, I studied how personal characteristics such as human and social capital and previous employment experiences affect a person’s likelihood of being self-employment. The study uses a multinomial logistic model to consider the effect of these predictors on the likelihood of four outcomes: (1) wage employment (the reference outcome of the model), (2) unemployment, (3) self-employment in non-incorporated business, and (4) self-employment in incorporated business. I use data from the 2014-2016 Current Population Survey’s (CPS) Annual Social and Economic Supplement (ASEC) for the model.

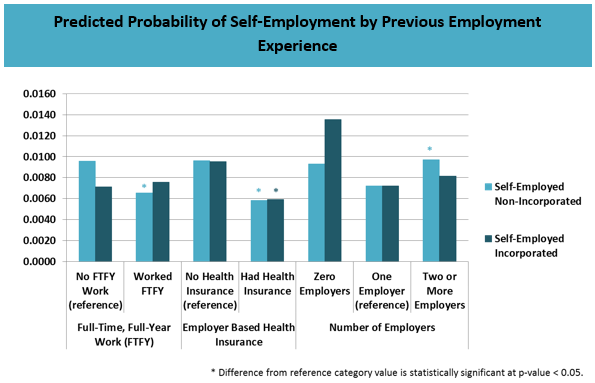

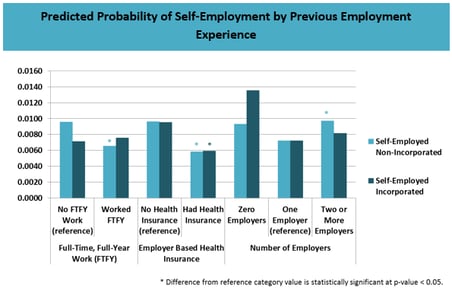

I found support for the “push” hypothesis of self-employment. The study shows that people with better employment experiences in the previous year were significantly less likely to be self-employed in a non-incorporated business in the current year. These people were more likely to be wage employees instead. For instance, people who worked full-time, full-year (working at least 35 hours a week for 50 weeks of the year) or who had health insurance through their employer in the previous year were less likely to have a non-incorporated business. Likewise, workers who had just one employer in the previous year (indicating more stable work) were less likely to have a non-incorporated business than workers who had two or more employers. Most tellingly, people who were employed at all in the previous year were much less likely than previously unemployed persons to have a non-incorporated business in the current year.

On the other hand, previous employment experience did not have much effect on a person’s likelihood of having an incorporated business. Neither previous full-time, full-year work nor the number of employers was significantly associated with having an incorporated business rather than wage employment. Likewise, being unemployed in the previous year was not significantly associated with having an incorporated business. However, workers with employer based health insurance were less likely to have an incorporated business rather than wage employment.

Examining self-employment in non-incorporated business separately from incorporated business highlights the differing ways that personal characteristics, particularly previous employment experience, affects the likelihood of being self-employed. This specification uncovers additional support for the “push” hypothesis of self-employment.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)