New Overtime Pay Rules from DOL: Employment Experience of Affected Workers

June 21, 2016 •China Layne

On May 18, 2016, the White House and Department of Labor (DOL) released a final rule updating overtime pay regulations, raising the standard salary level for exempt workers from $455 weekly to $913. Nonexempt employees are entitled to overtime pay; exempt employees are not. Effective December 1, 2016, workers earning less than $913 per week will not be eligible for exempt status, extending overtime pay protection to 4.2 million currently exempt workers. (DOL Fact Sheet: https://www.dol.gov/whd/overtime/final2016/overtime-factsheet.htm.)

In this extended blog post, we examine the work experiences of exempt workers affected by these new rules, including their education levels, occupations, industries, earnings, and benefits.* We also compare the education and work experiences of these workers to those earning $913 or more per week. This post offers an additional perspective on the new regulation by providing an employment profile of the workers who are affected.

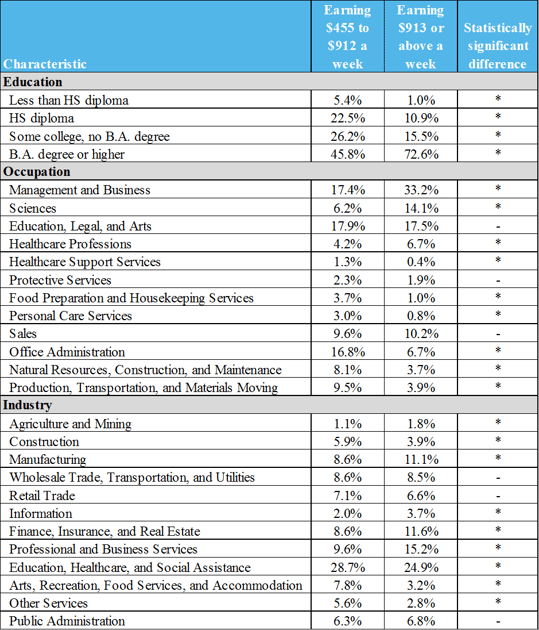

Education

Of exempt workers earning <$913, 54% have less than a bachelor’s degree and 23% have only a high school diploma. Of exempt workers earning ≥$913, 73% have at least a bachelor’s degree.

'*' indicates a difference that is significant at the 0.05 level.

Occupation

Specific occupations for the two groups reflect the differing education levels of lower and higher earning exempt workers: 46% of lower earning workers are employed in Management, Sciences, Education, and Healthcare professional occupations, compared with 72% of higher earning workers.

Larger shares of lower earning workers are employed in Office Administration, Production, and Natural Resources occupations. Similarly, larger shares of lower earning workers are employed in Food Preparation, Personal Care, and Healthcare Support services.

Industry

The largest share of lower earning workers (28.7%) are employed in Education, Healthcare, and Social Assistance industries, similar to the share of higher earning workers (24.9%). In line with the differences in occupation, smaller shares of lower earning workers are employed in Professional Services, Finance, and Information industries. Larger shares of lower earning workers are employed in Construction, Arts, and Other Services.

'*' indicates a difference that is significant at the 0.05 level.

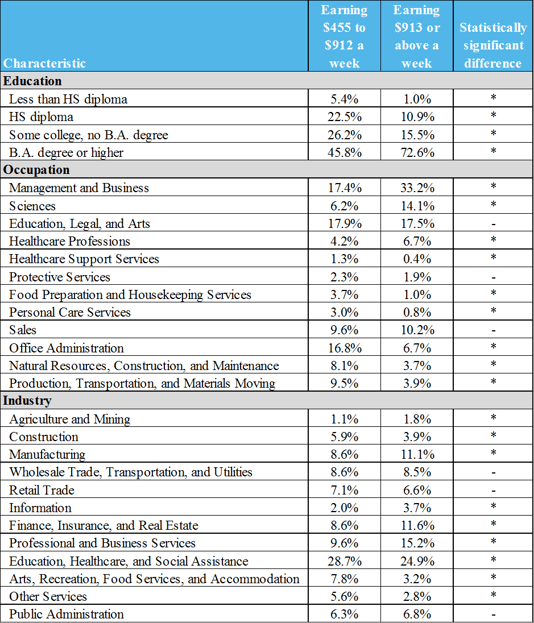

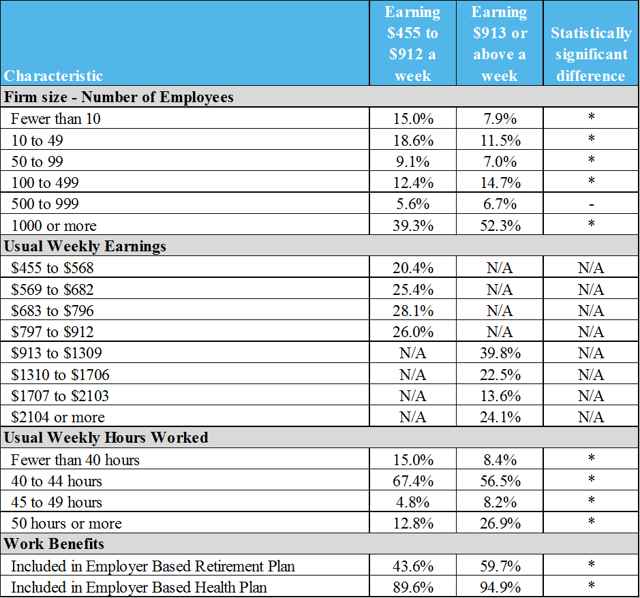

Firm Size

A large share of lower earning workers are employed in organizations with <100 workers (42.7%), with nearly a third working in organizations with <50.

In comparison, nearly 60% of higher earning workers are employed in organizations with ≥500 employees.

Usual Weekly Earnings

Of lower earning exempt workers, 20% earn $455–$568 weekly (the lowest salary band) and about 26% earn $797–$912.

Of higher earning exempt workers, about 40% earn $913–$1,309 weekly (the lowest salary band) and about 24% earn ≥$2,104.

Usual Weekly Hours Worked

Just over 72% of lower earning workers work 40–49 hours weekly, compared with almost 65% of higher earning workers. Only about 13% of lower earning workers work ≥50 hours, compared to nearly 27% of higher earners.

Work Benefits

Smaller shares of lower earning exempt workers receive employer-sponsored benefits:

- Around 44% have employer-based retirement plans, compared with 60% of higher earning workers.

- About 90% of lower earning workers have employer-based health plans, compared with 95% of higher earning workers.

Overall, exempt workers earning $455–$912 a week represent a variety of occupations, industries, and employment experiences. However, these lower earning workers generally have different employment experiences from exempt workers earning ≥$913. Lower earning workers generally:

- Have lower educational attainment

- Are more likely to work in non-professional occupations and for small organizations

- Are less likely to have access to employer-based retirement or health plans

The new regulations set a standard salary level for the exempt worker population that corresponds to real differences in the education and work experiences of higher and lower earning exempt workers. Understanding these differences between higher and lower earning exempt workers will help us better anticipate the effects of the new regulations.

More Information

For more information on the Department of Labor’s final rule on overtime pay regulations, see: https://www.dol.gov/whd/overtime/final2016/.

*Note: Data for this post comes from the Current Population Survey, 2015 Annual Social and Economic Supplement and Earner Study. The data were accessed through the Integrated Pubic Use Microdata Series (IPUMS), produced by the University of Minnesota Population Center. Respondents are considered exempt workers if they answer “No” to the question “Are you paid by the hour?”

Summit’s Program Evaluation (PE) is a trusted provider of quantitative program evaluation services to Federal Departments and Agencies. By blending administrative data with external data sources and applying rigorous methodologies, Summit’s PE team conducts high-quality, low-cost evaluations, helping our clients:

- Empirically determine which programs work and why

- Decrease program costs and better target resources

- Maximize program impacts

For more information on Summit’s engagements and capabilities related to worker protection programs, see: http://www.summitllc.us/services/program-evaluation.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)