Is Fair Value for Federal Credit in the Future?

March 5, 2015 •Anthony Curcio

In the first two months of 2015, legislators introduced House and Senate bills requiring Fair Value accounting of subsidy costs for Federal Credit Programs. The introduction of these bills follows two recent efforts by policymakers over the past few years (including the Honest Budget Act of 2013 and the Budget and Accounting Transparency Act of 2014).

In the first two months of 2015, legislators introduced House and Senate bills requiring Fair Value accounting of subsidy costs for Federal Credit Programs. The introduction of these bills follows two recent efforts by policymakers over the past few years (including the Honest Budget Act of 2013 and the Budget and Accounting Transparency Act of 2014).

The bills (found here for the House and here for the Senate) propose the following provisions:

- Fair Value cost scoring of Federal Credit programs

- Publication of program budget justification materials

- Separate accounting for “essential preservation expenses”

- On-budget status for Fannie Mae and Freddie Mac

- Development of various reports on Fair Value

So what do they mean by “Fair Value accounting”?

What is the difference between FCRA and Fair Value?

The main provision of the bills is to introduce Fair Value cost scoring for Federal Credit programs.

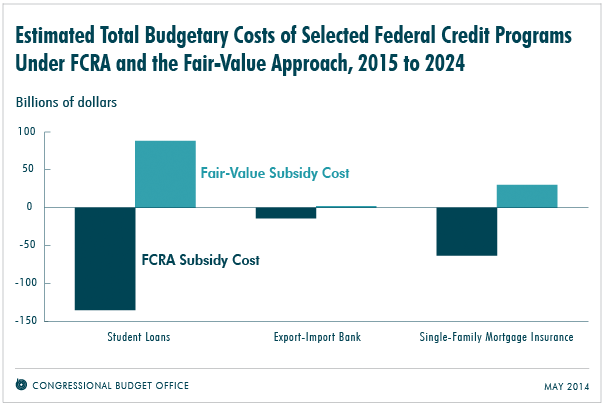

Currently, the Federal Credit Reform Act of 1990 (FCRA) governs the budgetary scoring of Federal Credit programs. Under FCRA, the cost of Federal Credit programs are calculated as the net present value of cash flows over time, discounted by the Treasury discount component. Federal agencies have used this current scoring method for over two decades to estimate program subsidy costs.

The Fair Value approach requires scoring to include a “risk component” in addition to the FCRA Treasury discount component. The Congressional Budget Office (CBO) supports Fair Value measurement of subsidy costs, whereas the Office of Management and Budget (OMB) opposes it. For more detail on the Fair Value approach, please refer to Financial Accounting Standard Board guidance (ASC 820 (formerly FAS 157)).

What does this mean for Federal Credit Programs?

If the proposed bills become law, Federal agencies will need to implement Fair Value scoring for their Federal Credit programs. This implementation may impose challenges for unprepared programs.

New Scoring Methods: Currently, both bills require Federal agencies to report cost using the Fair Value approach for the fiscal year 2017 President’s Budget. According to Federal budget cycles, the fiscal year 2017 President’s Budget is prepared in late 2015. This timing means that Federal agencies likely need to develop Fair Value approach scoring methodologies well in advance of the 2017 fiscal year.

Changes in Subsidy: A recent CBO report indicates that, for certain programs, the Fair Value approach is likely to result in higher program subsidy costs compared to scoring under FCRA. With this in mind, Federal agencies should consider the effects of changes in program subsidy. Negative-subsidy or Zero-subsidy programs should pay particular attention to the potential effects of increased costs on appropriated subsidy, program volume, and availability to borrowers.

How Summit Can Help

As advisors to numerous Federal agencies, Summit is keeping a close eye on pending legislation surrounding the Fair Value accounting for Federal Credit. We are working with Federal Credit and accounting experts to determine how these legislative actions will potentially impact Federal agencies and their operations.

This post was written with the help of May Chen.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)