The Impact of Interest Rates on Federal Interest Costs

January 12, 2023 •Joseph McCormack, PhD

With contributions by Sarah Cunningham

In 2022, the federal deficit approached almost $1.4 trillion. This represents an increase relative to pre-COVID spending. The current deficit will contribute an additional 4.5% of the total debt, measuring $31.3 trillion. As it stands, the debt now measures at 120% of current U.S. gross domestic product. To finance this level of spending, the federal government must issue Treasury bonds and pay interest on these bonds, a cost that is significantly growing due to rising interest rates. This cost will play a role in future policy decisions and quickly approach the debt limit of $31.4 trillion that was last set in December 2021. Failure to raise the debt limit can adversely impact government programs’ funding should the government be unable to raise money through the issuance of new bonds.

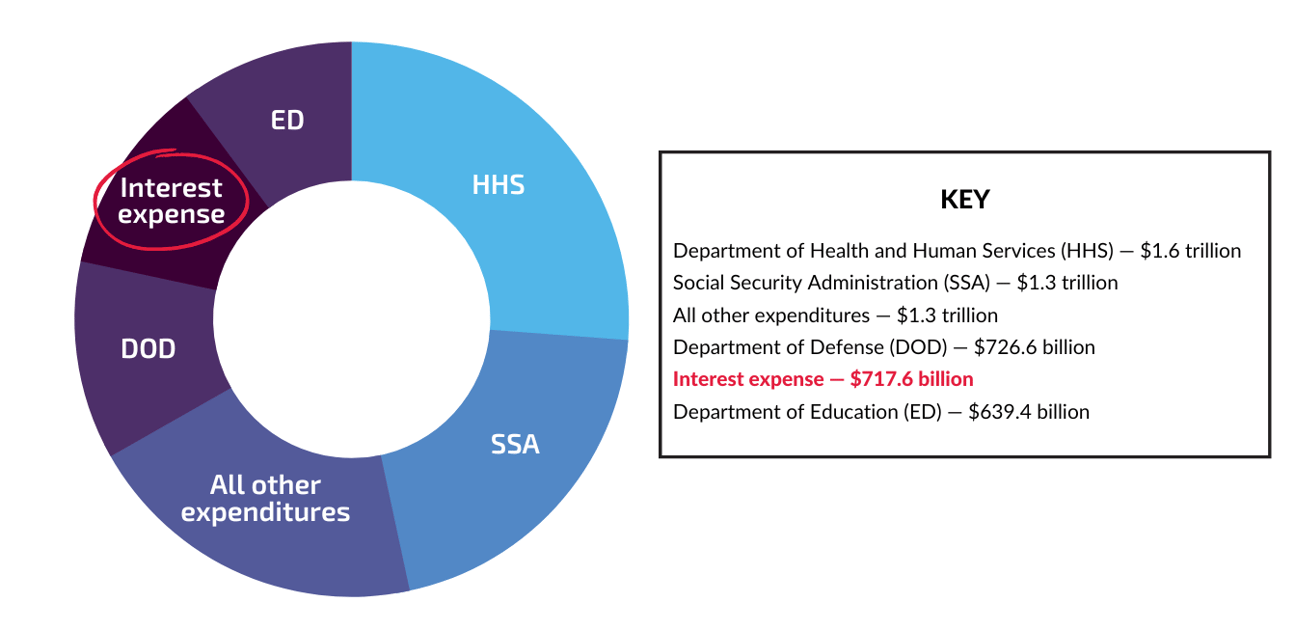

The interest expense paid by the federal government is the cost incurred for borrowing funds. This may be interest paid yearly or the difference in the purchase price and face value of the loan. As older bonds expire, new bonds must be issued to finance the payments. This rollover of bonds can become costly, especially in the current environment of rising interest rates, because older, maturing bonds may have been previously issued at lower rates. The cost of the interest expense is correlated with the federal funds rate as set by the Federal Reserve, as shown in Figure 1 below.

Figure 1: Federal government current expenditures and interest payments vs. federal funds rate, 2018–2022

Source: https://fred.stlouisfed.org/graph/?g=YDxz

Rising interest rates have caused the interest expense paid by the federal government to increase by 27.6% for the current year relative to 2021. This can be problematic, as higher costs leave less funds for other policy objectives, crowding out government spending and exacerbating the deficit.

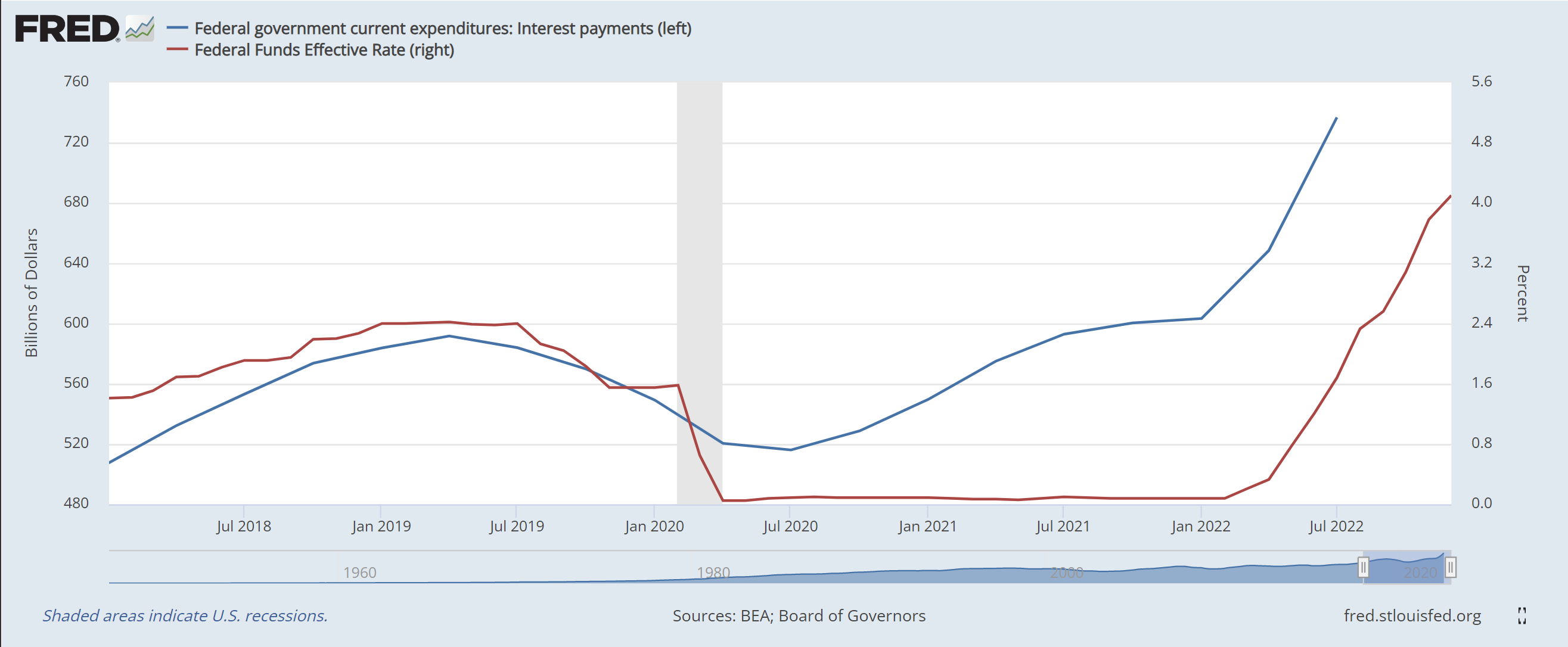

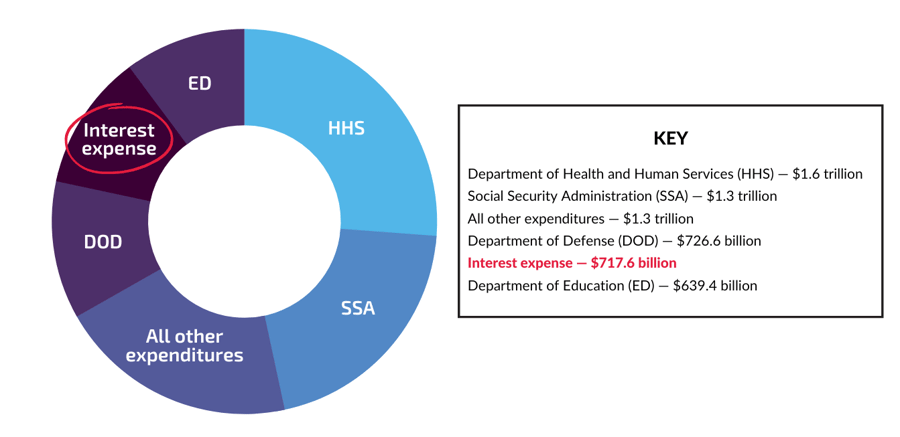

For 2022, the interest expense is expected to be $717.6 billion. This amount exceeds all that the federal government spends on the:

- Department of Education: $639.4 billion

- Department of Veterans Affairs: $273.9 billion (2.5 times more)

- Department of Transportation: $113.7 billion (6 times more)

- Department of Housing and Urban Development: $29.3 billion (24 times more)

- Department of the Interior: $13.9 billion (51 times more)

Figure 2: Federal government spending in 2022

Source: https://home.treasury.gov/system/files/136/OUTLAYS_BY_AGENCY.pdf

In the federal budget, the nearest line item to expected interest expense is defense spending ($726.6 billion). There is also a concern on who holds U.S. debt and the potential national security issues that raises if they choose to no longer accept new debt issuances.

The government is then faced with difficult choices. To maintain current deficit levels, it may be forced to reduce other forms of government spending or increase taxes. Interest rates are expected to remain high as the Fed has taken a hard stance on its approach to fight inflation. Thus, the interest expense cost will continue to grow as old debt is rolled over into new debt at these higher interest rates. This can have a big impact when setting policy objectives. The rising costs of interest expense can crowd out investments in education and infrastructure, further pushing the U.S. away from a sustainable fiscal path.

Additionally, the government may often be forward-looking, assuming that today’s financial investment will spur economic growth and overlook potential negative impacts of the debt spending or economic downturns that could require greater spending. Government spending may also be forecast to be lower because many programs have sunset provisions (a measure within a statute, regulation, or other law that provides that the law shall cease to have effect after a specific date) that project lower long-term costs. However, these programs are typically extended, causing costs to continue to grow and further delaying the solution. The growing deficit and debt have caused consistent increases to the debt ceiling, a limit that will be reached in the coming months and will require yet another upward adjustment. The debt ceiling has never been adjusted downward.

Given the current economic environment and rising interest rates, this discussion becomes increasingly important and pivotal for the federal budget. During the COVID-19 pandemic, the U.S. Treasury enjoyed unprecedented low interest rates that allowed it to finance spending at historically low levels. However, on December 14, 2022, the Federal Reserve raised its targeted rate for the seventh consecutive time in 2022. The most recent increase was half a percentage point, 50 basis points (bps), raising the effective rate between 4.25% and 4.5%. This has caused the current rate for a 30-year Treasury bond to be near 3.5% to 4.0%, a level not seen since before 2010.

Table 1: Federal Reserve targeted rate raises in 2022

| Date | BPS Increase | Federal Funds Rate |

| March 17, 2022 | 25 | 0.25% to 0.50% |

| May 5, 2022 | 50 | 0.75% to 1.00% |

| June 16, 2022 | 75 | 1.50% to 1.75% |

| July 27, 2022 | 75 | 2.25% to 2.50% |

| September 21, 2022 | 75 | 3.00% to 3.25% |

| November 2, 2022 | 75 | 3.75% to 4.00% |

| December 14, 2022 | 50 | 4.25% to 4.50% |

Source: https://www.federalreserve.gov/

Federal Reserve Chairman Jerome Powell has noted that his desire to curb rising costs will have the Fed continue to raise rates as a contractionary step to fight inflation. However, the impact of these rate changes affects all aspects of the economy, including savings accounts, mortgage rates, and the federal budget. Those rising rates will continue to cost the federal government more as it works to finance its debt, continuing to expand the deficit unless further action is taken.

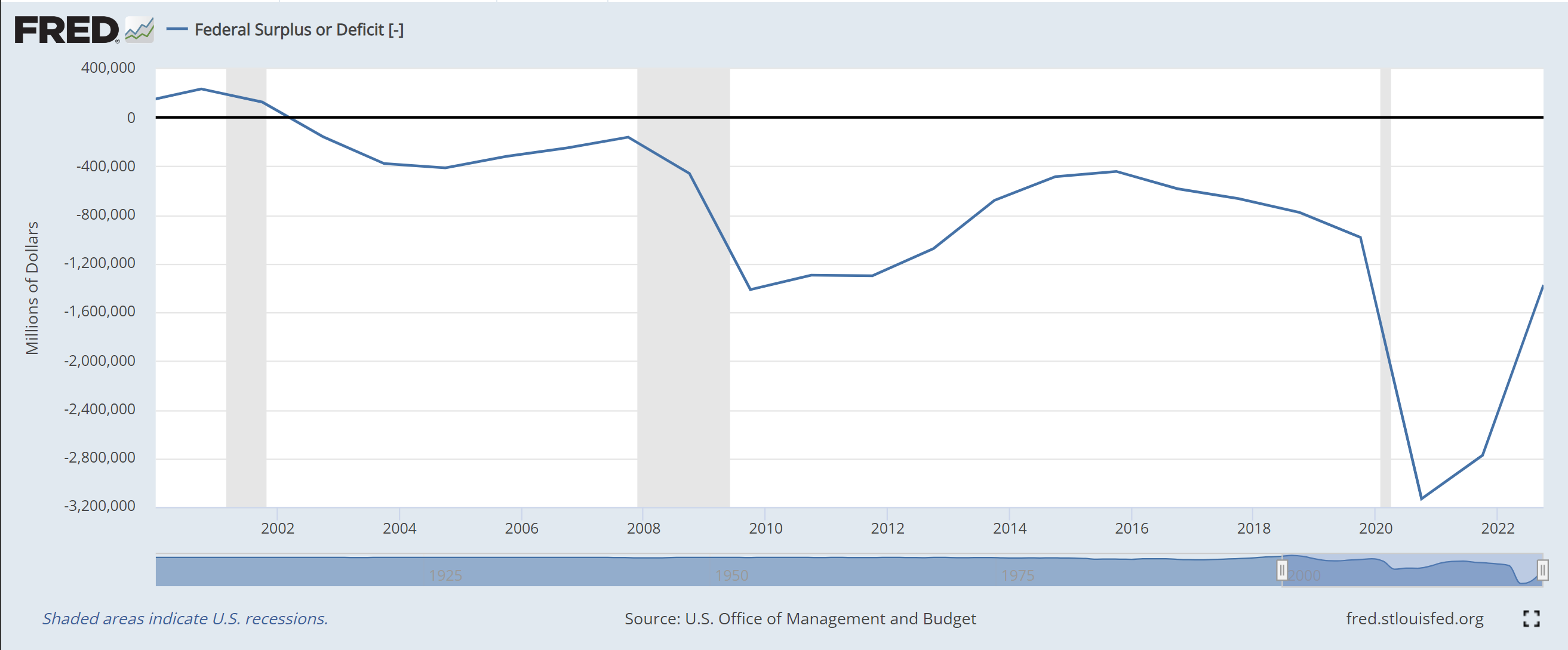

While government deficit is nothing new, the size of the deficit is becoming problematic. Although the impact of the pandemic is waning and the deficit is on track to return to pre-pandemic levels, this may be short-lived. The government continues to avoid making spending cuts and hard choices to rectify the situation. Furthermore, the deficit is only projected to grow; the last time a surplus was observed was in 2001.

Figure 3: Federal surplus and deficit history, 2000–2022

Source: https://fred.stlouisfed.org/graph/?g=YDxL

Source: https://fred.stlouisfed.org/graph/?g=YDxL

As previously mentioned, deficits are only one reason debt must be issued; maturing debt must also be rolled over into new debt. This is required because the new debt is used to finance payments to prior bond holders. This forces older debt, potentially issued at lower interest rates, to be refinanced at today’s higher interest rates—significantly increasing the cost to the government.

When interest rates fall, the Treasury can issue new debt at a lower cost than when it was previously issued; however, when rates rise the cost becomes more expensive over time. This relationship can be observed in Figure 1 above, which shows the correlation between the federal funds rate and the interest payments the government makes on federal debt.

Unfortunately, there are no simple solutions on how to address this rising cost. The size of the interest expense is impacting U.S. spending and prevents investment in other government programs. Alternatively, it may require new taxes to finance spending at current levels that could adversely impact many households struggling under recent inflationary pressures. Congress and the president must make difficult choices to avoid further crowding out of other government investment.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)