How DOL Could Improve Form 5500 for Group Health Plans

November 2, 2016 •Heather Brotsos

On July 21, 2016, the Department of Labor (DOL) Employee Benefit Security Administration (EBSA), Internal Revenue Service (IRS), and Pension Benefit Guaranty Corporation (PBGC) proposed a rule that would change how employee benefit plans share information with the government. This proposal, which revises the existing Form 5500, is intended to make data more useful and protect employees. DOL has encouraged stakeholders to submit public comments on these changes. Read our other posts about the proposed rule here.

Summit recently submitted comments to the proposed rule that would revise Form 5500. In this post, we explore some of our own suggestions DOL could use to strengthen the form.

dol cOULD add a column to collect the number of participants in addition to the number of covered persons.

The current and proposed Form 5500 uses the term participant for employees who are enrolled in welfare benefit plans. The number of covered persons is defined as the sum of participants, beneficiaries, and dependents. Proposed changes to the Schedule A will ask for the total number of covered persons associated with each type of benefit. Form 5500 will continue to collect the total number of participants separate from their beneficiaries and dependents. However, without tracking the number of participants by type of benefit, analysts will still have an incomplete picture of the types of benefits accessed by participants.

For example, consider a single employer plan. If life insurance policies are offered to all employees at no cost, then we would expect the total number of participants on the Form 5500 to be the total number of employees, all of whom receive life insurance benefits. If the plan does not provide health benefits at zero cost, the total number of participants in the health plan may be substantially less than the number receiving life insurance benefits. However, the proposed field on the Schedule A will not capture this difference because it includes dependents in addition to participants.

dOL COULD Request Additional Specificity to Part IV Health Benefit Claim Processing and Payment.

Part IV of Schedule J asks group health plans to report detailed counts across a host of measures. We’ve examined these measures with an eye towards the analysis potential of this data. Most of these suggestions add specificity to the data element under consideration. This specificity will help improve data quality and reduce inconsistencies in data reported across plans.

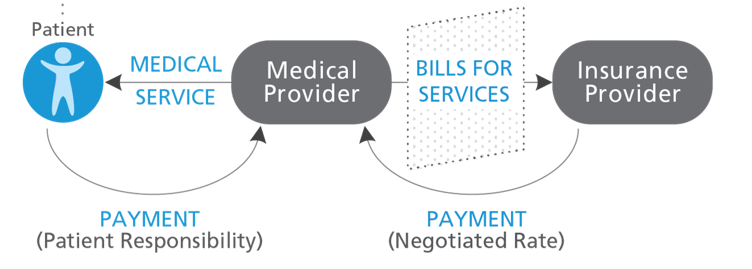

What is a claim? On the surface, this appears to be a simple question with a simple answer. A claim is a bill for medical services rendered that is submitted by the medical provider to the insurer. In practice, the claim filed is comprised of all services provided during a distinct encounter by a single provider. A claim may include a single service for an office visit or may include many different services for a hospital stay.

DOL distinguishes between pre- and post-service claims:

- “The term ‘pre-service claim’ means any claim for a benefit under a group health plan with respect to which the terms of the plan condition receipt of the benefit, in whole or in part, on approval of the benefit in advance of obtaining medical care.”

- “The term ‘post-service claim’ means any claim for a benefit under a group health plan that is not a pre-service claim.”

If plans report data at the claim level, this could obfuscate the quantity of services provided. Further, plans may interpret this request differently, as some report claims as the number of services while others report at the higher claim level definition. This could lead to significant data quality concerns when comparing and aggregating data across plans.

For purposes of this form, we recommend specifying the definition of a claim as a single line of service. This definition offers the simplest unit for reporting and analysis and is a common way of organizing data across plans. Additionally, adjudication occurs at this level, which aligns with the subpopulations requested in Part IV (e.g. paid, denied). If plans reported data at a higher level, the scenario where one service is paid and one is denied creates a reporting dilemma, as the claim could be counted in more than one group. This definition further ensures that all plans report information in a similar way, which is crucial for analysis and interpretation.

Follow our blog for more coverage on the Form 5500 proposed rule.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)