Form 5500: What Could Change for Group Health Plan Managers

October 26, 2016 •Heather Brotsos

On July 21, 2016, the Department of Labor (DOL) Employee Benefit Security Administration (EBSA), Internal Revenue Service (IRS), and Pension Benefit Guaranty Corporation (PBGC) proposed a rule that would change how employee benefit plans share information with the government. This proposal, which revises the existing Form 5500, is intended to make data more useful and protect employees. DOL has encouraged stakeholders to submit public comments on these changes. Read our other posts about the proposed rule here.

Summit recently submitted comments about a proposed rule that would revise Form 5500. In this post, we discuss the parts of the proposed rule that pertain to group health plans.

Extension of reporting requirements to group health plans with less than 100 members.

One of the biggest proposed changes to Form 5500 involves extending reporting requirements to group health plans that are subject to ERISA and have fewer than 100 members. We sought to find out how many of these small plans already file and how many would be required to file under the proposed rule.

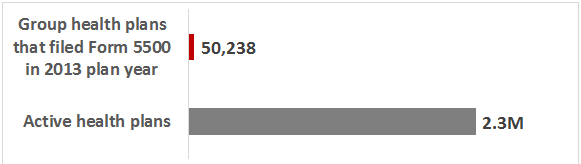

How many health plans currently file the Form 5500?

According to the DOL Group Health Plans Report, 50,238 health plans filed for the plan year ending date in 2013. Of these 50,238 plans, 2,550 have fewer than 100 members. These numbers compare to an estimated 2.3 million total health plans in existence. Based on this report, only a small fraction of health plans currently file.

Figure 1: Number of group health plans that filed Form 5500 in 2013

How many plans does this proposed reporting requirement affect?

While we know that there are approximately 2.3 million health plans, we wanted to estimate how many of these are small group health plans.

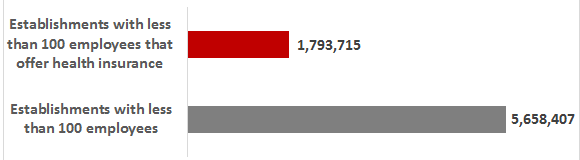

Most group health plans are classified as small (defined as having less than 100 members). However, there is limited information on precisely how many small health plans exist. To estimate this, we looked at data from the insurance component of the Medical Expenditure Panel Survey (MEPS). The MEPS reports insurance information at the establishment level. As reported in the 2015 survey results, there are 5,658,407 private-sector establishments with less than 100 employees, 31.7% of which offer health insurance. This equates to 1,793,715 establishments with less than 100 employees that offer health insurance.

Figure 2: Number of establishments with less than 100 employees that offer health insurance in 2015

Using this number as a proxy for the number of health plans with less than 100 participants, it appears that nearly 80% of health plans are currently exempt from filing due to plan size; but under the proposed rule, they would be required to file. However, we must keep in mind a few caveats regarding this estimate:

- Establishments do not have a one-to-one equivalence with firms. A firm may consist of more than one establishment in the case of a business with multiple divisions, branches, or subsidiaries. Among small firms, we assume this ratio is close to one.

- Firm size does not necessarily equate to plan size. All employees at a firm may not be eligible for health benefits. Additionally, some employees may opt-out of benefits.

- Plans that meet certain exception criteria (e.g. one-participant plan, church plan) are exempt from filing.

After taking into account these caveats, the population of small group health plans is still substantially larger than the number of small plans that file today (2,550 for plan year 2013). The proposed changes would require a significant number of plans to file that are exempt under the current regulation.

All Group Health Plans Would be required to file Schedule J, a new form that requires information on enrollment and claims data.

The proposed rule includes the introduction of a brand new schedule, Schedule J. This would be filed by all group health plans and would request plan level data on enrollment and claims processing. This schedule would satisfy new requirements created by the Affordable Care Act (ACA). It would collect information on participants, plan characteristics, coverage, benefits, policies, contributions, claims, and more. (Check out this article from Practical Law for a full list.)

For more information, you can find DOL’s fact sheet on the proposed rule here.

Get Updates

Featured Articles

Categories

- affordable housing (12)

- agile (3)

- AI (4)

- budget (3)

- change management (1)

- climate resilience (5)

- cloud computing (2)

- company announcements (15)

- consumer protection (3)

- COVID-19 (7)

- CredInsight (1)

- data analytics (82)

- data science (1)

- executive branch (4)

- fair lending (13)

- federal credit (36)

- federal finance (7)

- federal loans (7)

- federal register (2)

- financial institutions (1)

- Form 5500 (5)

- grants (1)

- healthcare (17)

- impact investing (12)

- infrastructure (13)

- LIBOR (4)

- litigation (8)

- machine learning (2)

- mechanical turk (3)

- mission-oriented finance (7)

- modeling (9)

- mortgage finance (10)

- office culture (26)

- opioid crisis (5)

- Opportunity Finance Network (4)

- opportunity zones (12)

- partnership (15)

- pay equity (5)

- predictive analytics (15)

- press coverage (3)

- program and business modernization (7)

- program evaluation (29)

- racial and social justice (8)

- real estate (2)

- risk management (10)

- rural communities (9)

- series - loan monitoring and AI (4)

- series - transforming federal lending (3)

- strength in numbers series (9)

- summer interns (7)

- taxes (7)

- thought leadership (4)

- white paper (15)