Fraud Mitigation Oversight Evaluation for the U.S. Small Business Administration

Challenge: The U.S. Small Business Administration (SBA) Fraud Risk Management Board (FRMB) was established in 2022 to serve as the agency’s designated anti-fraud entity. The FRMB is responsible for agencywide fraud risk management, issues agency-level governance policies on fraud risk, and supports oversight of the agency’s fraud risk prevention, detection, and response processes. Facilitating Fraud Risk Assessments (FRAs) with program offices is a key component of FRMB activities.

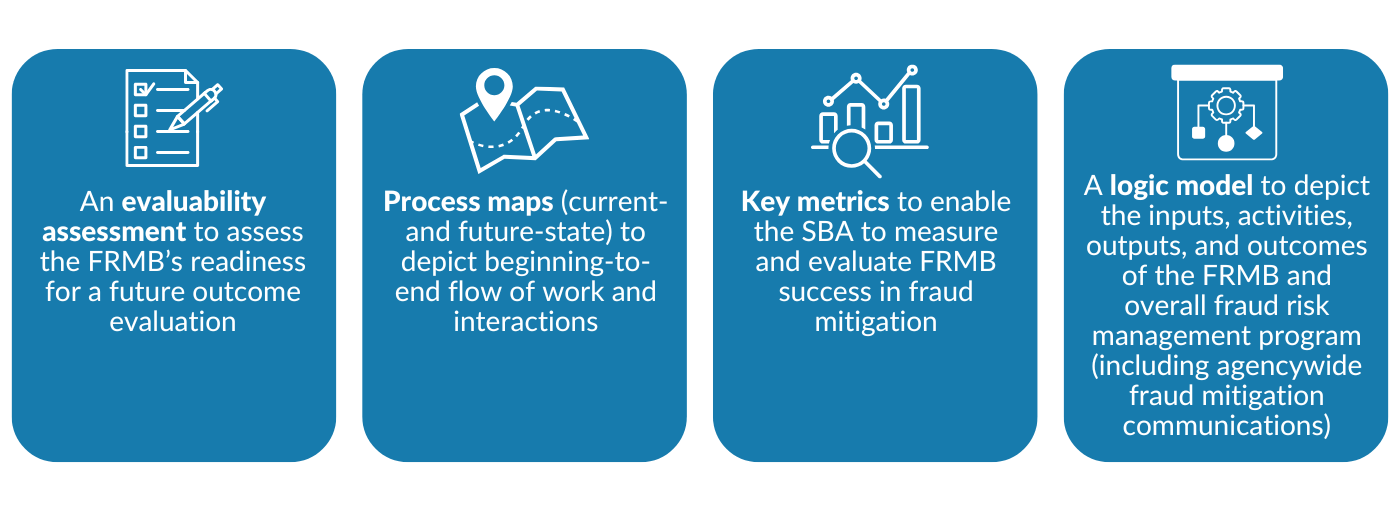

Summit completed this evaluation to identify opportunities for improvement (including leveraging new or existing technologies) and to assess readiness for a future outcome evaluation of the FRMB. This evaluation supported the SBA’s ongoing efforts to build a learning culture committed to identifying and preventing fraud across programs.

Solution: Summit conducted a formative evaluation, which was structured to collect information from a variety of sources. Methods included: Once data were collected and preliminary analysis had been completed, Summit conducted three participatory data analysis sessions to collaboratively interpret preliminary findings with key stakeholders.

Once data were collected and preliminary analysis had been completed, Summit conducted three participatory data analysis sessions to collaboratively interpret preliminary findings with key stakeholders.

Result: Summit made three recommendations to help the SBA continue to mature its fraud risk management efforts. Recommendations included:

Result: Summit made three recommendations to help the SBA continue to mature its fraud risk management efforts. Recommendations included:-

- Leveraging existing systems and infrastructure to standardize the tracking of key metrics to prepare for a future outcome evaluation of the FRMB’s role in fraud risk prevention, detection, and response across the agency.

- Establishing a clear feedback loop with program offices throughout the FRA process.

- Increasing SBA-wide knowledge and awareness of fraud risk mitigation through ongoing training and communication to continue advancing the agency’s fraud risk maturity.